Solving for the Climate Transition in High Yield

A holistic approach to climate considerations can offer an opportunity to invest in a diversified portfolio of high yield issuers that are committed to reducing or maintaining a low carbon footprint, while also targeting high current income and capital appreciation.

The climate transition is becoming increasingly urgent. Given the strengthening efforts to achieve net zero, as well as the rise in regulation, climate change mitigation is unquestionably playing a role in investment decisions across the globe.

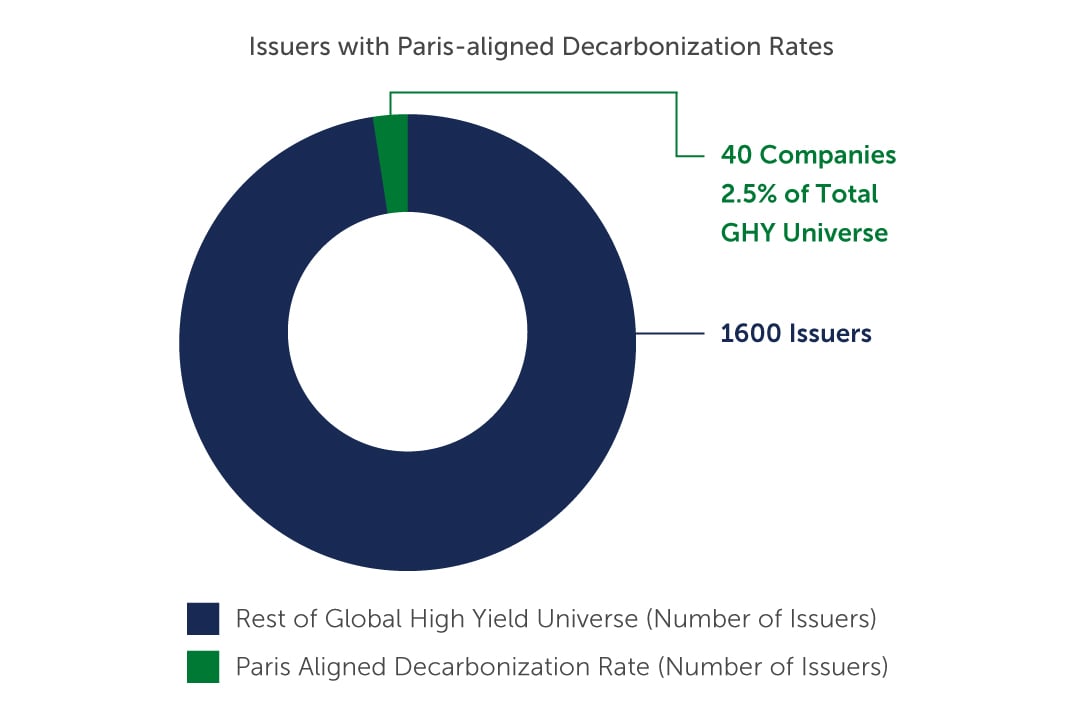

In recent years, much of the focus around the climate transition has centered on the Paris Agreement, which aims to limit global warming by holding temperature increases to well below 2°C and pursuing efforts to limit increases to 1.5°C. For companies to be Paris-aligned, they must be committed to reducing carbon emissions by around 7% p.a. by 2030 from a 2019 baseline. While there are plenty of companies on track to meet this goal—particularly large, higher-rated companies in asset-light industries—the reality is that for most issuers in the high yield universe, meeting this standard is much more challenging. This is partly due to the nature of the high yield universe, which consists primarily of large and mid-sized companies that typically prioritize capital to deleverage or grow their business. In addition to comprising many asset-heavy companies and industries—energy, metals & mining, for example—these companies can be smaller than their investment grade peers, with less personnel and capital to dedicate to meeting stringent climate targets or other initiatives. As a result, by our estimates, of the roughly 1,600 issuers across emerging and developed market corporate high yield, only about 2.5% are fully Paris-Aligned today.

FIGURE 1: A VERY SMALL PERCENTAGE OF THE HY UNIVERSE IS PARIS-ALIGNED

Source: Barings. As of February 28, 2023.

Source: Barings. As of February 28, 2023.