Reasons to Revisit EM Corporate Debt: A Short Duration Approach

A short-duration allocation to emerging market (EM) corporate debt offers the potential for attractive carry, incremental yield and portfolio diversification—while reducing interest rate sensitivity and preserving flexibility to reposition as monetary conditions evolve.

Market Context

Emerging markets have navigated a challenging backdrop in recent years, characterized by elevated inflation, aggressive rate hikes in developed markets, geopolitical tensions and heightened policy uncertainty in the U.S. With EM corporate bond valuations rebounding, default rates remaining low and yields still compelling, investors are reassessing the opportunity set—particularly as spreads have compressed toward multi-decade tights.

In our view, the case for EM corporates remains strong, with the short end of the curve offering a particularly attractive entry point. Short-duration EM corporates offer a compelling carry opportunity with lower interest rates and spread duration, enhancing portfolio resilience during periods of volatility. This positioning also provides liquidity and reinvestment flexibility as monetary conditions evolve.

1. Valuations Remain Compelling

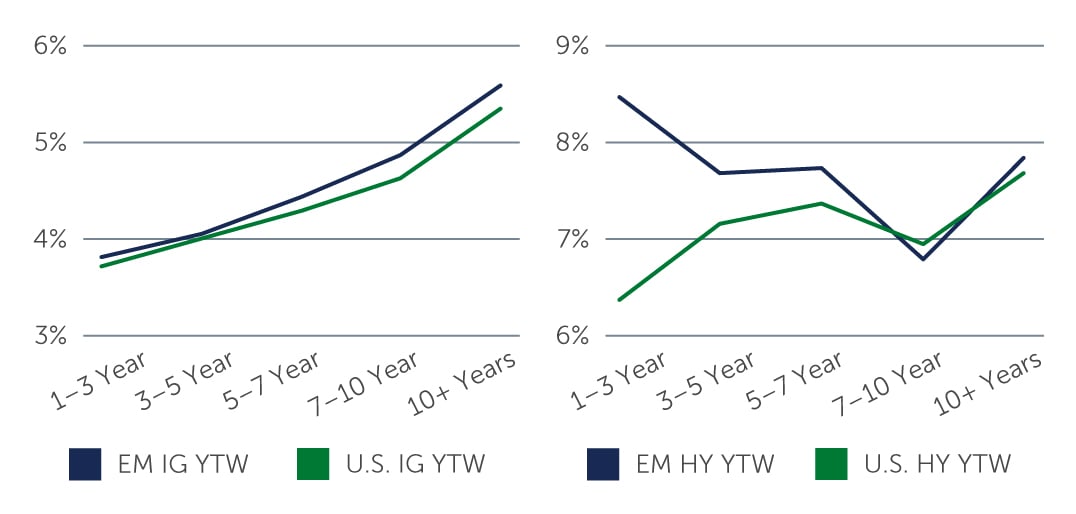

Despite a broad-based rally in global credit amid resilient U.S. growth and a dovish pivot by the Fed, EM corporate yields remain compelling relative to developed market (DM) peers. In particular, yields for EM high-yield (HY) bonds—currently in the range of 7.65%–8.45%, compared to 6.37%–7.67% for DM high-yield bonds—offer compelling potential returns.

Ongoing reform momentum, greater multilateral support and new mechanisms—such as debt-for-nature swaps and state-contingent debt instruments—have reduced systemic vulnerabilities within emerging markets. The growing role of local investors and central banks in EM debt markets, as well as a shift to local currency issuance, has further stabilized the EM corporate debt universe and narrowed the gap with developed markets.

Figure 1: Yields Remain Compelling in EM vs. DM

Sources: J.P. Morgan. As of November 16, 2025.

Sources: J.P. Morgan. As of November 16, 2025.

25-5004698