High Yield: Parsing Signals in a Shifting Market

High yield enters 2026 on solid footing, but tight valuations, shifting technicals, and a more uneven macro backdrop make selective positioning essential.

Global fixed income markets are starting the year with a backdrop of broadly steady economic momentum but mixed macro signals.

- In the U.S., stronger trends in fiscal policy, deregulation, and still‑accommodative monetary conditions are contributing to an economy that continues to outperform expectations.

- Globally, rates are diverging: several developed markets—particularly in Europe—have seen yields climb to cyclical highs, while U.S. yields ended the year below many international peers.

- Political and geopolitical crosscurrents continue to add uncertainty and occasional volatility, creating both challenges and entry points.

Within this environment, high yield bonds and loans have delivered solid returns, but arguably have limited room for further price appreciation. Regional differences remain important: European inflation appears to be more contained, policy responses vary, and relative value continues to shift. As investors look ahead, the priority is balancing income with careful monitoring of macro and geopolitical dynamics.

Fundamentals: Credit Quality & Sector Divergence

Credit quality across high yield remains broadly stable. Issuers are disciplined, leverage is manageable, and earnings momentum is widening across sectors—beyond just large tech. But sector dispersion remains significant.

- U.S.: Building materials and chemicals face persistent headwinds, with chemicals pressured by global oversupply and margin compression.

- Europe: Building materials are seeing early tailwinds from housing activity and fiscal initiatives, while chemical producers remain challenged by higher input costs and competition from lower‑cost exporters.

- Across both regions, the energy sector is stronger than in prior cycles, with healthier balance sheets and improved ratings. Still, volatility in oil prices and ample supply argue for caution.

Against this backdrop, defaults remain contained but are concentrated among lower‑rated issuers. As a result, security selection will be critical as pressure increases in parts of the CCC and single‑B space.

Technicals: Shifting Supply & Demand Dynamics

Market technicals are evolving as expectations for higher M&A activity point to increased new issuance after a period of tight supply. This could rebalance an issuer‑friendly environment. In loans, the most acute pressure is in lower‑rated segments. Repricings and resets across the CLO market have driven consistent selling of even mildly stressed names—pushing some single‑Bs and CCCs to levels not fully explained by fundamentals. Structural caps on CCC-rated loan allocations within CLOs create potential opportunities where technicals, not credit deterioration, have driven weakness.

Across the broader market, spreads are tight, limiting price upside. Investors are becoming more selective, focusing on income durability, credit resilience, and clear catalysts. With more issuance expected and CLO activity still influential, technicals may normalize—or become modestly more challenging—as the year progresses.

Where We See Opportunity

Opportunities remain highly selective and driven by idiosyncratic setups more than broad trends.

Loans:

- Certain discounted weaker single‑Bs and CCCs appear attractive where price declines reflect technical pressure rather than deteriorating fundamentals.

- As selling pressure wanes, issuers with stable cash flow and improving balance sheet visibility may see recovery, supported by the seniority and floating‑rate nature of the asset class.

Bonds:

- Discounted short-duration credit and higher‑quality BBs offer durable income, with discounts often reflecting potential early refi “pull to par” dynamics, particularly in the U.S. market

- Select single‑Bs and CCCs with company‑specific catalysts—such as refinancing, balance sheet actions, or takeout potential—may unlock value.

- Moderate duration helps dampen rate sensitivity while still capturing carry.

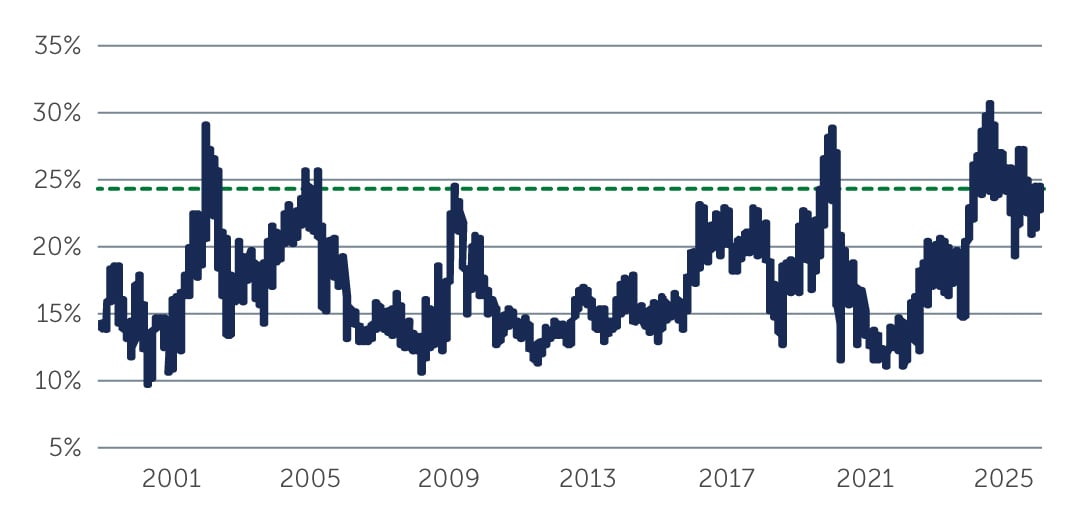

As shown in Figure 1, CCC bonds make up roughly 12% of the index but are contributing nearly a quarter of the total spread. This means they are contributing more to index spreads than their share of the market would suggest, and more than they have historically. Select CCCs also stand out against a U.S. economy that continues to show greater resilience than many forecasts imply. With growth remaining firm, expectations for rate cuts may continue to drift lower—supporting credit fundamentals and extending the runway for lower‑rated issuers.

Figure 1: CCCs are Contributing Nearly a Quarter of the HY Index Spread

Source: Barclays U.S. Corporate High Yield Index. As of December 2025.

Source: Barclays U.S. Corporate High Yield Index. As of December 2025.

Regional pockets:

- Europe: Select credits that could benefit from fiscal stimulus, such as those linked to improving construction activity, which is showing early momentum, may offer opportunities going forward.

- U.S.: A mix of higher‑quality carry and targeted exposure to sectors benefiting from broadening earnings—and a still-resilient economic backdrop—remains appealing.

Across markets, the emphasis is clear: focus on credible deleveraging plans, consistent cash flows, and identifiable catalysts.

Conclusion

High yield enters the year on a stable base, but the path ahead is more nuanced. Opportunities exist, supported by broader earnings growth, rising M&A activity, select dislocations, and a U.S. economy that continues to outperform expectations. But valuations are tight and the macro backdrop is still shifting.

In this environment, performance will hinge less on market beta and more on bottom‑up credit selection. Identifying issuers with improving fundamentals and clear value catalysts will be central to capturing targeted upside across both bonds and loans.

26-5132727