CLOs: Resilience in the Face of Uncertainty

CLOs have enjoyed strong demand this year as investors perceived a favorable risk-return balance—but the path ahead looks less straightforward.

By almost every measure this year—whether it’s new issuance, secondary market volume, or year-to-date performance—collateralized loan obligations (CLOs) have demonstrated remarkable resilience. Indeed, the CLO market continued to perform well, relative to similarly rated corporates, in the third quarter. Through the end of September, AAA, AA and single-A CLOs returned 2.43%, 3.05% and 4.09%, respectively, compared to -2.83% for U.S. investment grade corporates. BBB, BB and single-B CLOs returned 5.83%, 6.99% and 8.36%, outperforming U.S. high yield corporate returns of 0.56%.1 While the floating-rate nature of the asset class has certainly helped drive these results during a period of rising interest rates, CLOs have also benefitted from investors’ cautious optimism over the year regarding the prospects for the U.S. economy.

But as the economic outlook begins to darken and geopolitical tensions mount, can the strength continue? In our view, while there are certainly challenges in store—particularly if the mood of the market shifts more toward “risk-off” in the near to medium-term—CLOs remain relatively well-positioned. Although we continue to see benefits to staying up in quality and liquidity, opportunities are also emerging in other areas like CLO equity and private credit CLOs.

A Strong Starting Point, But Challenges Persist

While fundamentals continue to exhibit strength, the picture has deteriorated slightly. In particular, leveraged loan defaults have slowly ticked up, with the 12-month trailing default rate hitting 1.3% at the end of September, compared to 0.9% at this time last year.2 As higher interest rates put further pressure on companies’ interest coverage margins, defaults could continue to move higher, toward the range of 3-4%—although even at these levels, they would not exceed the stress capacity that CLO structures were built to withstand.3 Nonetheless, this backdrop could be challenging for certain BB-rated tranches, particularly some older vintage deals that have taken some losses yet still have larger exposures to tail-risk credits. Loan recovery rates also remain a concern of the market, since they too are likely to be lower this cycle than the historical average of 70%, and in many cases may take longer to realize.4

Technical forces have also begun to shift. Through much of the third quarter, CLO new issuance volumes were relatively muted, which provided support to spreads in the secondary market. However, that dynamic is starting to reverse, with new issue volumes picking up, while at the same time secondary volumes remain strong as sellers look to lock in gains before the end of the year. In addition, while the higher-for-longer sentiment over interest rates would seem to favor floating-rate instruments, the reality is that an extended period of higher rates—combined with persistent inflation and lower economic growth—could put pressure on below investment grade credit. In such a scenario, CLOs would likely trade off in sympathy.

Pockets of Opportunity

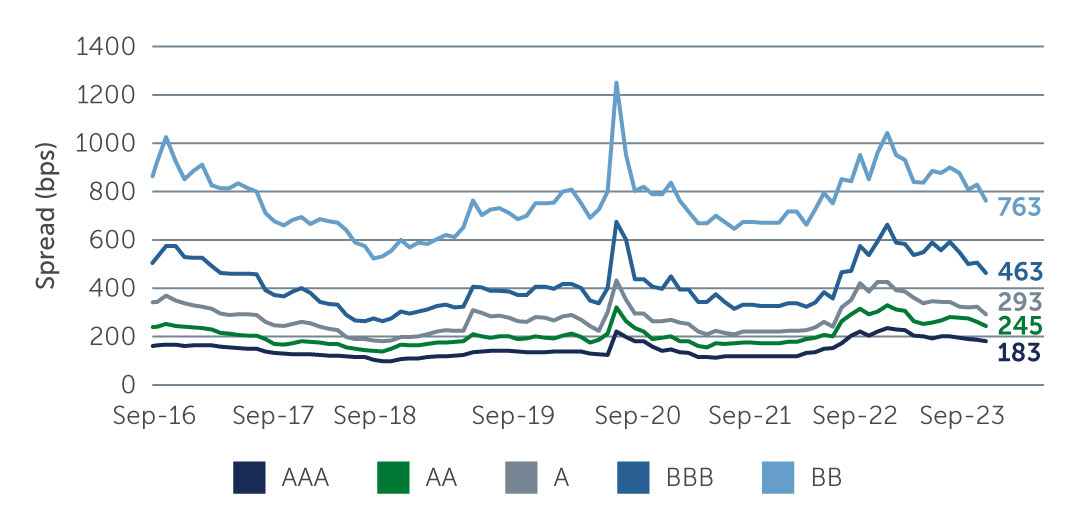

While the road ahead looks uncertain, we continue to see potential opportunities across the capital structure, particularly in higher-quality tranches. On a risk-adjusted return basis, the AAA new issue space continues to look appealing. With base rates still above 5%, the current coupon on a new issue AAA CLO is roughly 7%.5 Spreads also remain wide relative to historical averages—and continue to look attractive despite some tightening during the third quarter—and the credit risk component of AAAs is minimal.

Figure 1: CLO Spreads Remain Wide Relative to Historical Averages

Source: J.P. Morgan. As of September 29, 2023.

Source: J.P. Morgan. As of September 29, 2023.

Lower in the capital structure, secondary CLO equity also looks interesting. While the majority of the mezzanine CLO market has rallied significantly this year, equity tranches have not—and, in fact, in many instances are trading wider than several months ago—suggesting there may be room to rally going forward.6

For insurance companies and other long-term, buy-and-hold investors, another area that offers a potentially compelling value proposition is the private credit middle market CLO space. Historically accounting for about 10% of the market, private credit this year has grown to account for roughly 20% of total issuance.7 Relative to the broadly syndicated market, private credit CLOs offer the potential for a significant spread pickup—for example, AAA and AA tranches offer around 80-100 bps pickup in spreads.8 The pickup is even more compelling further down the capital structure. In the broadly syndicated market, new issue BBBs are currently being priced in the SOFR + 400-420 bps range for top tier managers, while new issue BBB middle market CLOs are pricing in the SOFR + 625-650 bps range.9 This suggests the potential for as much as 50% more in spreads, in return for giving up a certain amount of liquidity.

Looking Ahead

Given the heightened uncertainty in the market today, an emphasis on quality makes sense—particularly for investors that have a total rate of return focus. That said, credit remains compelling, and current market conditions are giving way to attractive medium- to long-term opportunities up and down the capital structure. Adding to the case for CLOs are the robust structural protections and potential for considerable incremental yield relative to similarly rated investment grade and high yield corporate credit. Of course, active management and careful manager selection, particularly at the lower end of the capital structure, will be crucial to minimizing potential risks and capitalizing on relative value opportunities in the months ahead.

1. Source: J.P. Morgan. As of September 29, 2023.

2. Source: S&P Leveraged Loan Index default rate. As of September 29, 2023.

3. Source: S&P.

4. Source: Citi. As of August 31, 2023

5. Source: Barings. As of October 12, 2023.

6. Source: J. P. Morgan. As of September 29, 2023.

7. Source: J.P. Morgan. As of October 6, 2023.

8. Source: Barings. As of October 12, 2023.

9. Source: Barings. As of October 12, 2023.