CLOs: Standing Out in a Strong Market

Given their floating-rate nature and attractive incremental yield potential, CLOs continue to stand out in this year’s credit market rally.

Collateralized loan obligations (CLOs) continue to gain momentum as worries about a near-term recession fade and sentiment gradually improves. With U.S. Federal Reserve rate cuts likely to arrive later than expected, and with fewer cuts potentially in the cards, the floating-rate nature of the asset class also continues to provide a strong tailwind. Indeed, the first quarter saw strong positive returns across the capital structure. AAA, AA and single-A CLOs returned 1.84%, 2.33%, and 2.68%, respectively, while BBB, BB and single-B CLOs returned 3.49%, 6.43%, and 11.12%.1

Although there are a number of risks—geopolitical and otherwise—that could introduce volatility going forward, we expect the backdrop to remain largely supportive and believe CLOs remain well-positioned relative to other fixed income asset classes.

Demand Outpacing Supply

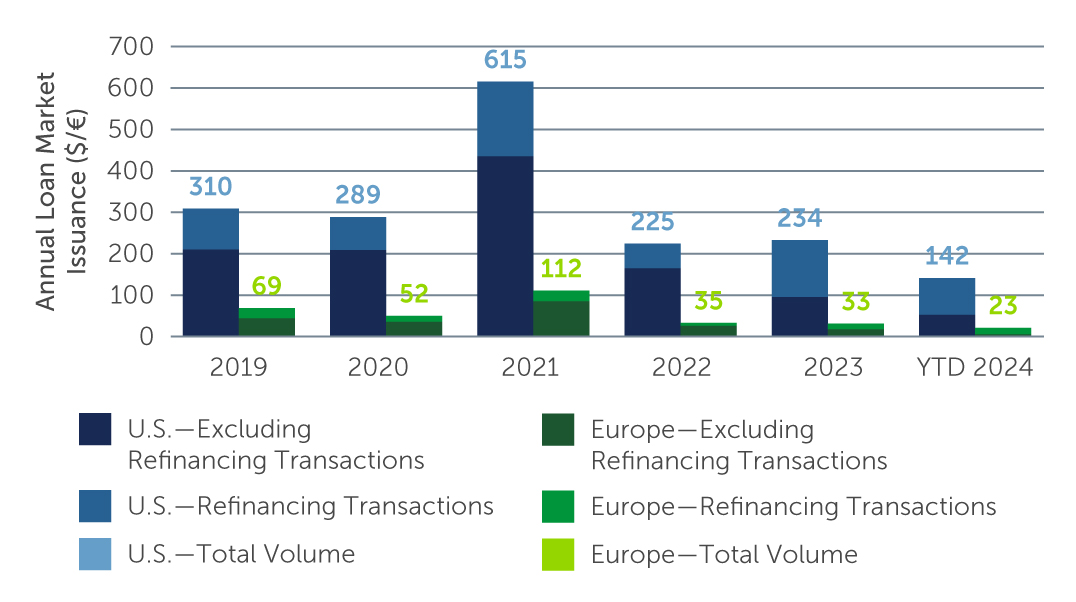

Demand for CLOs up and down the capital structure remains robust. This is partly due to the return of banks and other AAA buyers to the market, whose growing confidence in the macro backdrop has translated into an increased appetite for risk assets. Compounding this technical strength, the still-elevated coupons received on the April payment dates will provide significant funds to re-deploy. On the supply side, new issuance has been less robust than expected following a flurry of activity in mid-February—with most activity coming from refinancings and resets as managers look to capitalize on strong market conditions and reprice liabilities (Figure 1). The combination of strong demand and limited supply should further contribute to the positive technical backdrop and remain supportive of spreads in the near term.

Figure 1: New Issuance in Loans

Source: J.P. Morgan. As of March 31, 2024.

Source: J.P. Morgan. As of March 31, 2024.

Benign Default Outlook, But Manager Selection is Critical

The aforementioned technical strength, coupled with the continued tailwind from still-high interest rates, has helped keep loan prices elevated and made CLO formation more challenging. One factor that could derail this dynamic and potentially impact manager performance in the coming months is defaults in the underlying loans—although to be clear, we expect any forthcoming defaults to be idiosyncratic in nature versus widespread. Indeed, while there have been concerns that a higher-for-longer rate environment—and therefore increased borrowing costs—would lead to a rising tide of defaults in the leveraged loan market, the majority of borrowers have been able to adjust. Defaults, therefore, look likely to remain in the relatively benign range of 2.5% to 3%, in line with historical averages.2

Moreover, the relatively small number of borrowers that are facing more pressing challenges are often opting to engage in liability management exercises (LMEs) to proactively restructure their debt. LMEs tend to lead to more positive outcomes for CLO managers in general, but particularly for those who have scale and experience in workout and restructuring scenarios. This further underscores the importance, for CLO investors, of careful manager selection.

Up in Quality & Liquidity

In the current environment, we continue to favor staying at the upper ends of the quality and liquidity spectrums. Given the ongoing credit rally and spread tightening, tranches across the capital structure are currently trading closer to fair value—but AAA-rated CLOs continue to offer the potential for compelling risk-adjusted returns, albeit to a lesser extent than in recent months. While we continue to also monitor potential opportunities in the private credit CLO space, the spread pick-up relative to broadly syndicated CLOs has compressed and supply has not been as robust as many anticipated—as some of the larger borrowers in the private space have returned to the public market, where they can fund their needs at a lower cost and with more flexible documentation.

For investors who target higher returns and venture into the mezzanine part of the capital structure, we advocate for up in quality and liquidity across both managers and deals. Specifically, we see value in new issue BB deals from liquid, well-performing managers and in some shorter secondary offerings with limited exposure to tail risk credits. New issue portfolios are being ramped with a conservative bias while also offering compelling current coupons of around 11.5–12%.3 In addition, CLO equity has become more interesting than it has been in recent years as spreads on CLO liabilities have tightened and the arbitrage for new issue equity has become more compelling.

Looking Ahead

While credit markets, generally, have experienced a strong start to the year, CLOs continue to stand out relative to other fixed income asset classes given their robust structural protections and potential for considerable incremental yield relative to similarly rated investment grade and high yield corporate credit. But several identifiable risks loom on the horizon—chief among them, the potential fallout from shifts in the global geopolitical and political landscapes. The presence of risk in its many forms is the reason we believe a disciplined approach, coupled with active management and careful manager selection, will continue to be a crucial component in successfully navigating this market.

1. Source: J.P Morgan. As of March 31, 2024.

2. Source: Barings. As of March 31, 2024.

3. Source: Barings. As of March 31, 2024.