Securitisation Arrears: A Barometer of Consumer Well-Being

The Australian securitised debt market is closely tied to consumer lending. In this paper, the Gryphon team examine that connection and its impact on consumers through the rest of 2025.

- Positive outlook for securitised debt in 2025, underpinned by expected rate cuts and stable house prices

- Geopolitical and trade volatility remains, however markets and consumers are showing resilience

- The Gryphon team is well-equipped to adapt to economic shifts and manage portfolios in line with evolving consumer trends

The Link Between Securitised Debt and Consumer Lending

Consumer Well-Being Steers Arrears Levels in Securitised Debt Markets

The Australian securitised debt market is closely tied to consumer lending products. In 2024, of the $80 billion in term market issuance, 77% ($61 billion) was in Residential Mortgage-Backed Securities (RMBS), which is secured by residential mortgages. An additional $16 billion in Asset-Backed Securities (ABS) term deals were issued, of which Gryphon estimates around half were backed by consumer debt products such as auto and equipment loans, personal loans, credit cards, and Buy Now Pay Later (BNPL).1

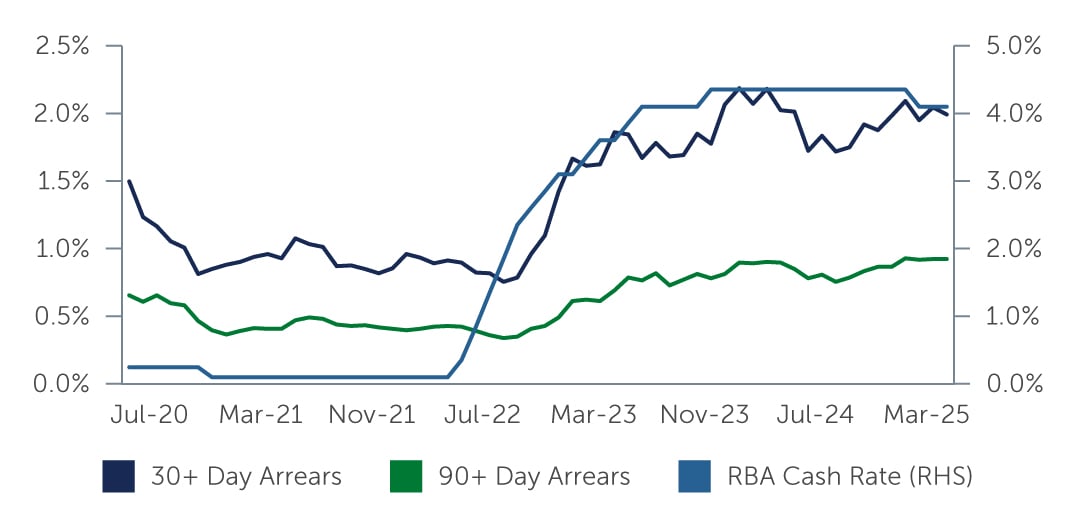

Unlike many global markets, Australian mortgages are predominantly variable rate, leaving borrowers highly sensitive to changes in the Reserve Bank of Australia (RBA) cash rate. Rate movements can significantly influence borrowers’ ability to repay mortgages and other debts.

Figure 1: RMBS Arrears vs. RBA Cash Rate

Source: Gryphon. As of 31 March, 2025.

Source: Gryphon. As of 31 March, 2025.

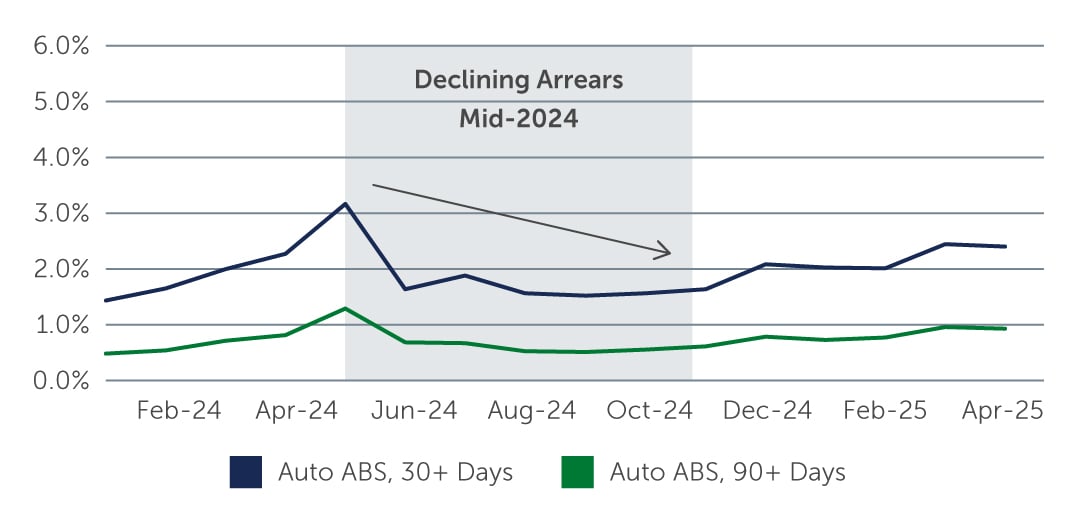

ABS transactions are particularly sensitive to changes in consumer sentiment, with rational distressed borrowers typically defaulting on car loans before mortgages. As such, ABS arrears are one of the earliest lagging indicators of broader consumer stress. Prepayment behaviour on mortgages and other consumer debt products also offer valuable insights into consumer sentiment.

Current State of Consumer Well-being in Australia

Arrears Easing, But Prepayments Slowing Amid Uncertainty

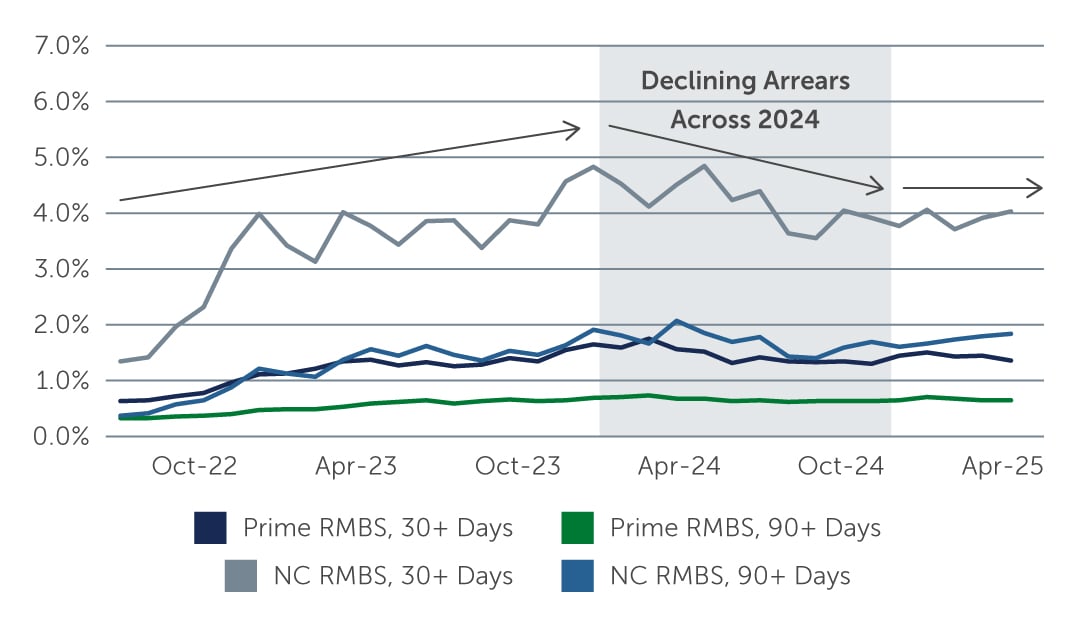

Consumer sentiment has been steadily improving since the RBA paused rate hikes in late 2023, with a notable uplift in late 2024 that has largely held.2 Arrears performance of RMBS and ABS transactions (where secured by consumer lending products) act as a lagging indicator of consumer well-being and tell a similar story.

From late 2022, rising rates and inflation drove arrears higher. However, RMBS and ABS arrears normalised across Australian market in 2024, with an expected seasonal spike through the Christmas period and return to moderation in early 2025. Abating inflation and two rate cuts by the RBA (and anticipation of more to come) appear to be having the expected positive impact on household balance sheets.

The Australian consumer has benefited from strong wage growth (remaining above 3%p.a.3) along with continuing low unemployment (hovering steady around 4% for over a year4). Both support consumers’ ability to repay mortgages and other debts.

Figure 2: Arrears Trends—RMBS

Source: Gryphon. As of 28 April, 2025.

Source: Gryphon. As of 28 April, 2025.

Figure 3: Arrears Trends—ABS

Source: Gryphon. As of 28 April, 2025.

Source: Gryphon. As of 28 April, 2025.

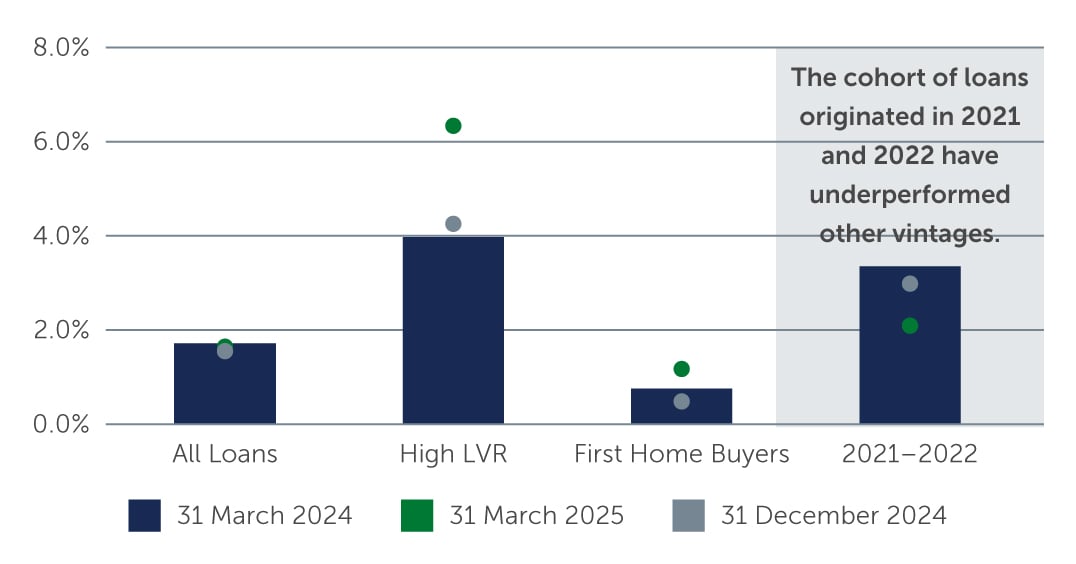

The Gryphon team has been monitoring three mortgage sub-sets: high loan-to-value ratio (LVR) loans, first home buyers, and pre RBA rate hike purchases in 2021–2022. Notably, the first two groups showed improving arrears over the last 12 months through March. However, we’ve observed a rise in arrears levels for the 2021-2022 cohort—likely because these borrowers are the most exposed to changes in loan serviceability as interest rates increased.

Figure 4: Non-Conforming RMBS 90+ Day Arrears

Source: Gryphon. As of 31 March, 2025

Source: Gryphon. As of 31 March, 2025

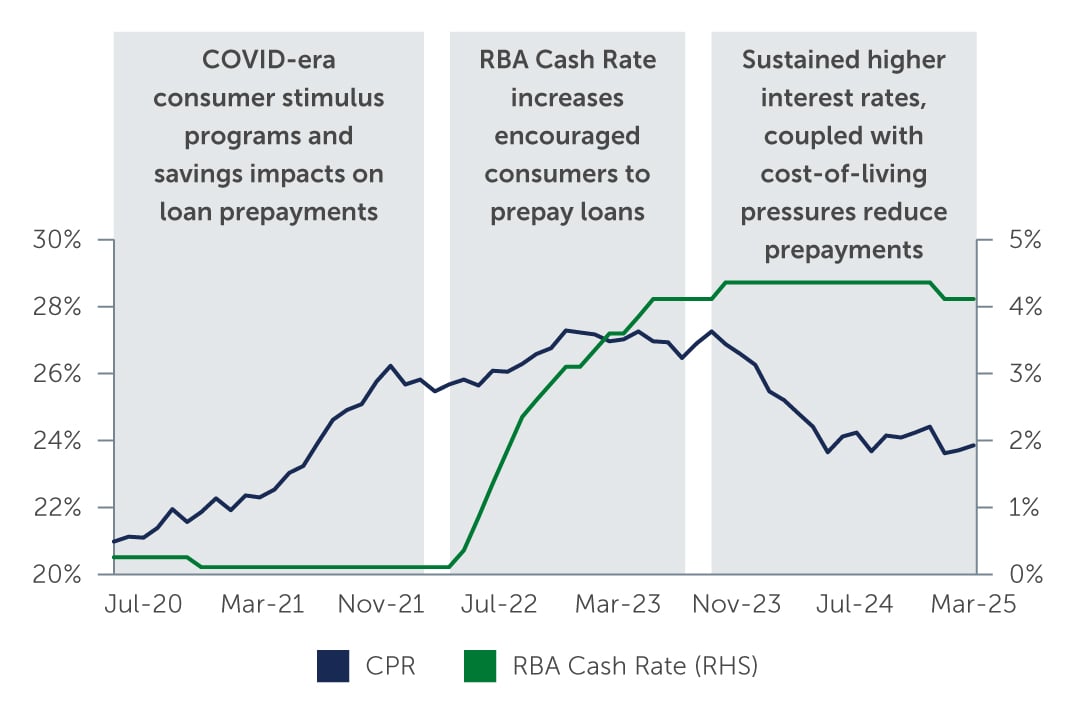

Our data has also shown a slowdown in mortgage prepayment rates. While there are several factors that influence the prepayment rate, when considered with a low unemployment in Australia, we attribute the slowdown to a cautious consumer market. Consumers are prioritising liquidity over paying down debt amid an uncertain economic outlook.

Figure 5: RMBS Prepayment Rates vs RBA Cash Rates

Source: Gryphon. As of 31 March, 2025

Source: Gryphon. As of 31 March, 2025

The 0.25% RBA rate cuts in February and May this year were equivalent to a monthly repayment reduction of $125 for the average residential mortgage in Gryphon’s funded portfolio ($310K). The RBA is widely expected to cut rates further in 2025, which should further improve consumer arrears metrics.

Consumer Outlook in Australia for 2025

Rate Cuts and House Price Stability to Support Consumers Through Market Volatility

While ongoing macroeconomic uncertainty is likely to influence sentiment, consumer debt performance should be supported by further RBA rate cuts and moderating inflation. We will continue to monitor economic data for any deterioration in consumer-related metrics, using the team’s specialist skillset and bespoke analytics capabilities. We will also be closely monitoring our internal data for migration to later-stage arrears buckets.

Summary

- Securitised debt performance in 2025 looks strong, supported by rate cuts and housing stability

- Geopolitical and trade volatility remain, however markets and consumers have demonstrated resilience and an ability to look through this noise.

- The specialist team at Gryphon is supported by excellent analytics capabilities and is well-equipped to adapt to economic shifts and manage portfolio composition in line with evolving consumer dynamics.

All currencies are denominated in AUD unless otherwise stated.

1. Source: Australian Securitisation Forum. As of 7 June, 2025

2. Source: Westpac Consumer Sentiment Index. As of 13 May, 2025

3. Source: ABS Labour Force, Australia. As of 15 May, 2025

4. Source: ABS Wage Price Index, Australia. As of 14 May, 2025

25-4561224