CLOs: Constructive But Cautious

The CLO market remains well-supported by strong demand and resilient fundamentals, yet uncertainty persists. As macro forces and credit dynamics evolve, a disciplined, selective approach will be key to capturing opportunity—especially as innovation continues to reshape the landscape.

The global financial landscape is marked by a delicate balance between resilience and recalibration. While growth has moderated from post-pandemic highs, the economy continues to expand at a measured pace. Central banks remain vigilant, with market participants closely attuned to signals regarding the extent of future policy shifts. Inflation, though off its peaks, remains a focal point for both policymakers and investors, shaping expectations across asset classes. Against this backdrop, risk assets have generally performed well, supported by steady demand and a constructive credit environment. That said, early October has seen a pickup in volatility, driven by a few high-profile defaults and shifting investor sentiment. Political developments and geopolitical tensions also continue to inject uncertainty, and while markets have absorbed shocks with notable efficiency, the mood has shifted toward more cautious optimism.

CLOs, for their part, remain relatively well-positioned. The market has been characterized by robust demand, particularly from institutional investors seeking incremental yield relative to other fixed income asset classes. Spreads also remain attractive relative to similarly rated corporate credit, while the underlying loan market has benefited from mostly healthy technicals and disciplined issuance. Although rates and tariffs are a source of uncertainty heading into 2026—and recent volatility has underscored the need for selectivity—CLOs so far have demonstrated a capacity to adapt.

Stable Fundamentals; Strong Demand

Fundamentals remain anchored by the relative stability of the leveraged loan market. While default rates in the loan market are expected to stay near or within long-term averages of 2-3%,1 the recent uptick in volatility—driven by high-profile defaults such as First Brands—has prompted some investors to reassess risk exposures.2 Rating migration has also persisted, with roughly $5 billion in net CCC downgrades in September, which modestly increased CCC concentrations in some portfolios.3 Nevertheless, these levels generally remain manageable relative to covenant thresholds, and we view the payment defaults as largely isolated events rather than a sign of broader deterioration—although they serve as a timely reminder that idiosyncratic risk can re-emerge quickly, even in a broadly constructive environment.

On the technical side, conditions remain constructive, underpinned by robust volume. U.S. CLO supply exceeded $150 billion in the quarter—the busiest on record.4 Notably, roughly 70% of that supply came from repricings, reflecting a market focused on optimizing existing structures rather than expanding through new issuance. Investor demand for CLOs has largely persisted as well—with insurance companies, asset managers, and ETFs providing a stable base of support—although some institutional reallocations and modest ETF outflows in early October reflect a more cautious tone. While questions linger about floating-rate demand under further monetary easing, recent trends suggest moderate, non-recessionary rate cuts may not materially dampen demand, particularly as investors continue to seek high-quality spread products. That said, if volatility persists, technical pressure could become more pronounced, particularly in lower-rated tranches.

Notably, CLO warehouse activity is at record highs, with roughly 300 open facilities in the U.S. and 150 in Europe.5 These warehouses are a key technical indicator, signaling expectations for continued CLO issuance and strong demand for leveraged loans. Their presence also provides a stabilizing force for loan prices: should volatility arise, any retracement is likely to be met with strong buying interest from warehouses, creating a “floor” under prices and limiting the risk of prolonged selloffs. Importantly, while positioning to act opportunistically if spreads widen, managers are keeping warehouse balances conservatively ramped. This strategy, combined with a focus on cleaner portfolios, underscores the market’s quality bias and readiness to adapt as conditions evolve.

Assessing the Opportunity Set

Opportunities in the CLO market remain attractive, though they require a selective approach. At the top of the capital structure, AAA and AA tranches continue to offer a compelling balance of safety and yield, making them a cornerstone allocation for insurance clients and other investors focused on capital preservation and liquidity. While spreads could still see modest tightening from here, higher-rated tranches continue to look appealing for their potential to offer stable risk-adjusted returns and attractive carry—especially given their risk-remote nature. In the mezzanine part of the capital structure, BB and single-B tranches offer higher yields but demand greater discernment as performance is more sensitive to credit migration and volatility. While we continue to look for opportunities in higher-quality secondaries that offer greater discount (but have less exposure to risky credits), the opportunity has narrowed somewhat in recent months. In lower-rated tranches in particular, investors continue to show a preference for cleaner new issues ramped with careful consideration of companies and sectors that could be adversely affect by tariffs.

CLO equity presents a nuanced but still-attractive opportunity, as returns are highly sensitive to liability pricing and the arbitrage between loan and CLO spreads. The traditional day-one arbitrage is now constrained, with loan prices hovering near par, but the ability to lock in tight debt spreads remains attractive. In this environment, managers must take a more disciplined approach to ramping portfolios and managing risks in order to make the arbitrage work. While a healthy pace of deal activity suggests this remains achievable, the margin for error is slimmer, and outcomes are increasingly path-dependent, relying on manager skill and market timing.

Innovation in CLO Structures

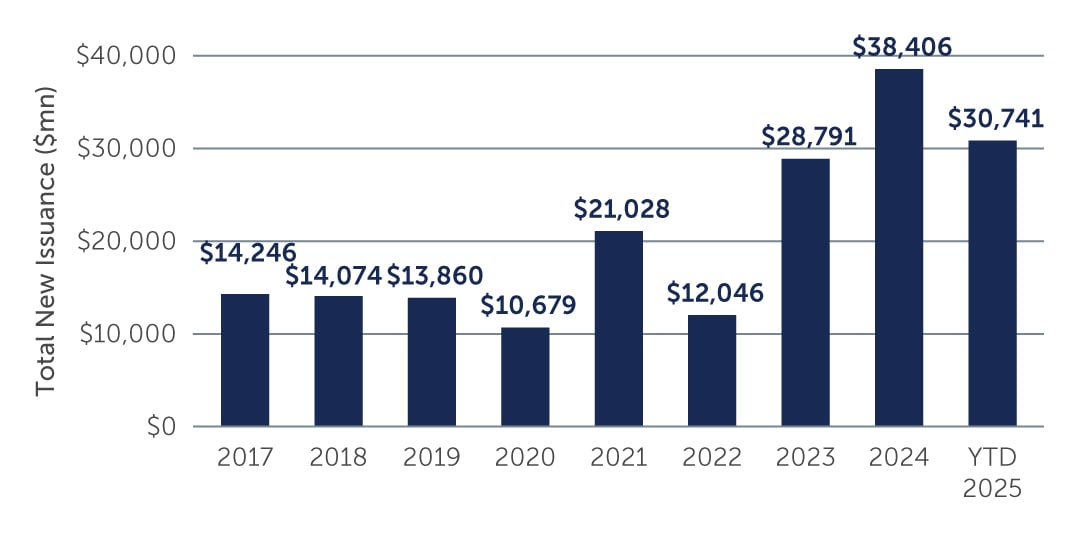

Beyond traditional broadly syndicated loan CLOs, opportunities are also expanding in private credit and infrastructure CLOs. Private credit CLOs have rapidly gained acceptance, with U.S. private credit CLO issuance reaching $44.2 billion in 2024 and $54 billion year-to-date—accounting for roughly 16% of overall issuance (Figure 1).6 While spreads still offer a meaningful pick-up relative to broadly syndicated CLOs, they have tightened notably from January highs, underscoring investors’ growing comfort with less liquid structures. Infrastructure CLOs, though earlier in their development, are also gaining traction as investors seek exposure to long-duration, essential assets with stable cash flows.

In our view, the innovation across the CLO landscape highlights a broader evolution: CLOs are increasingly being used as a flexible vehicle to access a range of asset classes—from broadly syndicated and middle market loans to infrastructure debt and commercial real estate.

Figure 1: Private Credit CLO Issuance is on the Rise

Source: BofA. As of October 2025.

Source: BofA. As of October 2025.

Key Takeaway

The CLO market continues to demonstrate resilience and steady demand, with managers actively prioritizing quality and liquidity. Senior tranches remain a reliable source of risk-adjusted returns, while opportunities in mezzanine tranches require careful evaluation. Although risks persist—from macroeconomic shifts and credit events to regulatory changes—the market’s robust and growing investor base provides a solid foundation for navigating uncertainty. At the same time, innovation in deal structures and the expansion into new asset classes that benefit from the CLO framework is creating new ways to capture value, reinforcing the importance of flexibility and forward thinking.

Recent volatility and a few high-profile loan defaults serve as a reminder that risks can re-emerge quickly, particularly in segments more exposed to credit events or liquidity shifts. In this environment, robust credit analysis and active risk management are essential. As the landscape continues to evolve, maintaining a disciplined and nimble approach will be essential to both managing risks and capturing opportunities as they arise.

1. Sources: S&P UBS Leveraged Loan Index; S&P UBS Western European Leveraged Loan Index; J.P. Morgan; Pitchbook. As of September 30, 2025.

2. Source: J.P. Morgan; S&P LLI & ELLI Factsheet. As of September 30, 2025.

3. Source: J.P. Morgan; S&P LLI & ELLI Factsheet. As of September 30, 2025.

4. Source: J.P. Morgan. As of September 30, 2025.

5. Source: US Bank. As of September 30, 2025.

6. Source: J.P. Morgan. As of September 30, 2025.

25-4901055