EM Debt: Navigating the Noise

Possible U.S. rate hikes, Omicron, and China are causes for concern, but select opportunities exist across sovereign, corporate and local debt.

The fourth quarter of 2021 saw a significant increase in risks for emerging markets debt (EM) investors. In China, two major real estate developers defaulted on their debt. Geopolitical tensions rose as Russia continued to build up troops along the Ukrainian border. And across a number of EM countries, interest rates rose. Brazil saw a dramatic increase, while in Central and Eastern Europe, where rates had already been steadily going up, the pace of the increases accelerated. At the same time, the U.S. Federal Reserve (Fed) became more hawkish to combat high inflation, announcing that it will taper its asset-purchase program by early 2022 and possibly raise rates shortly after. These conditions brought negative returns across sovereign (-0.44%), corporate (-0.61%) and local (-2.53%) debt in the fourth quarter and caused spreads to widen across the board.1

Risks Abound

China: Perhaps the biggest concern for investors across all emerging markets relates to the developments in China. Specifically, there are indications that China’s economic growth picture may be deteriorating, but—and maybe the bigger issue is—it is becoming harder for us as investors to understand the country's trajectory. Additionally, China has been imposing tougher regulations on industries such as technology, private education and real estate, with the regulatory crackdown on real estate also beginning to affect industries like heavy manufacturing, which has already seen a slowdown. These developments are all the more unsettling given that China, the world’s second-largest economy with $13.4 trillion in GDP, dramatically impacts demand in both EM and developed markets.

A More Hawkish Fed: The Fed’s commitment to aggressively combat inflation has led to questions around the path of future rate hikes and the withdrawal of liquidity. A more hawkish stance would be challenging for EM currencies, in particular, and would likely lead to currency depreciation in certain countries. Countries with fixed or rigid rate regimes would likely face the greatest difficulties, whereas countries with flexible exchange rates, like Brazil, Peru and Indonesia, may be better positioned.

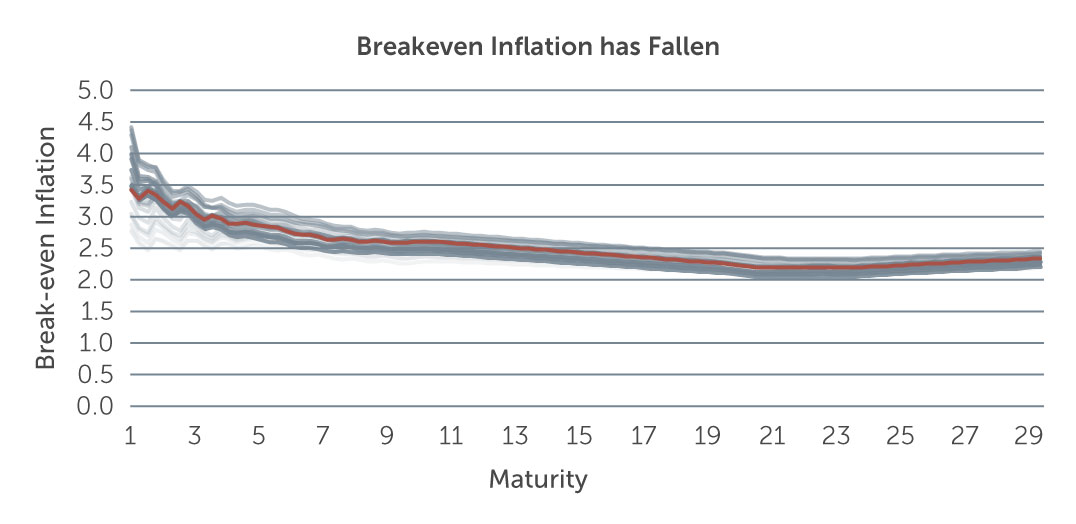

While expectations are for over three rate hikes in 2022, we do see one sign that might suggest a less aggressive path toward tightening. Breakeven inflation, or the difference between the nominal yield of a U.S. Treasury bond and an inflation-linked bond, fell in the fourth quarter. This is evident in Figure 1, which shows that the U.S. 10-year breakeven inflation rate dropped to 2.61% as of end December. The red line, representing the most recent data, is not at its 12-month low, but has come down notably since its peak several months ago.

Figure 1: A Possible Signal of a Less Aggressive Fed?

Lines represent weekly measurements with the red line being the most recent.

Source: Bloomberg. As of December 31, 2021.

In our view, this is an important measure to consider because it demonstrates where investors are pricing inflation—and a continuing decline in the breakeven rate might be enough for the Fed to take a less aggressive stance.

1. Source: J.P. Morgan. As of December 31, 2021.