Private Equity 2.0: Uncovering Value in a Shifting Landscape

Mina Pacheco Nazemi discusses the key trends driving today’s private equity market, the biggest challenges facing limited partners today, and where the Barings team is seeing the most compelling opportunities.

What are the noteworthy and emerging themes within private equity that investors should be aware of?

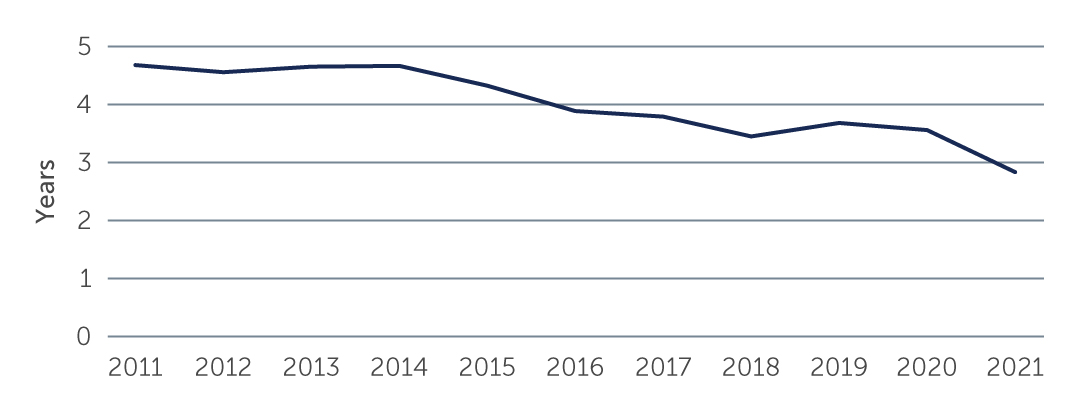

There are a number of notable trends impacting the private equity landscape today. For one, managers are coming back to market with increasing frequency and larger funds, meaning there are more funds in the market in general. Figure 1 illustrates the drop in fundraising cycles from ~4.7 years in 2011 to merely ~2.8 years in 2021. Alongside new opportunities, this inundation of re-ups has created challenges for investors already coping with existing exposures at or above target allocations. The volatility of the current public markets has further exacerbated the constraints that LPs face (denominator effect), making it more difficult for them to put money to work.

Figure 1: Average Time Between Funds

Source: Pitchbook 2021 Annual U.S. PE Breakdown. As of December 31, 2021.

Source: Pitchbook 2021 Annual U.S. PE Breakdown. As of December 31, 2021.

Coinciding with the trend toward larger funds, we have a seen a trend toward managers expanding the investible universe that they have traditionally operated within. This could mean expanding into new sectors, participating in larger deals or, in some cases, investing in strategies where they have not yet demonstrated expertise or track record. While this growth and evolution isn’t inherently problematic, LPs do need to ensure they are comfortable that managers—when expanding into these new areas—have the right amount of expertise to generate the expected returns as advertised.

Similarly, alignment between the LP and manager are of critical importance. In recent years, we’ve witnessed some degradation of this, specifically when it comes to the capital that managers, or general partners (GPs), have invested in their own funds. In some cases, even as managers have had successful exits, crystalized carry dollars, and raised subsequent funds—generating higher fees for the management team—the level of alignment has remained at the market standard of roughly 2%, instead of increasing commensurate with the manager's generated wealth. In our view, this can represent a red flag for LPs, and is something to monitor.

22-2335966