High Yield: A Strong Case for Floating Rate

While the negative shocks of late have impacted high yield markets, the asset class remains well-positioned overall—particularly loans, which can offer a degree of protection in a rising-rate environment.

Is volatility here to stay? It certainly seems that way following a tumultuous first quarter in which Russia’s invasion of Ukraine caused extreme moves across the capital markets and pushed inflation and commodity prices to recent highs. This environment proved challenging for all risk assets, and high yield was no exception. For the first quarter, U.S. and European high yield bonds were both down roughly 4.4%. Loans—which are floating rate and can offer a degree of protection against both credit and interest rate risk—fared slightly better as the U.S. Federal Reserve continued to raise rates, returning -0.1% and -0.5% in the U.S. and Europe, respectively.1

Strong Fundamentals, But Pricing Power is Key

Although markets fell sharply in response to Russia’s invasion of Ukraine, two different stories have emerged in the U.S. and Europe. In the U.S., economic growth, while moderating, has been fairly strong. Inflationary pressures have remained manageable, supported by a still-strong U.S. consumer with estimated excess savings of US$2.5 trillion.2 The story in Europe is a bit more clouded, as the economy has been hit harder by the Russia-Ukraine conflict. Given the region’s reliance on Russian commodities—mostly notably oil and gas, but also raw materials like aluminum and nickel, as well products like wheat—the economy could soon face pressures in the form of food and energy shortages.

On the positive side, corporate fundamentals continue to look strong. Revenues, cash flows and EBITDA levels, in many cases, have returned to or surpassed 2019 levels. Many issuers today also have lower leverage and higher levels of liquidity relative to past periods of rising rates, which should help them absorb higher inflation in the near term. This is partly due to elevated issuance over the last two years, as companies built up capital reserves to help weather the pandemic. As a result, while inflation could start to pressure margins going forward, many companies still have a decent amount of pricing power and have been able to pass through increased costs.

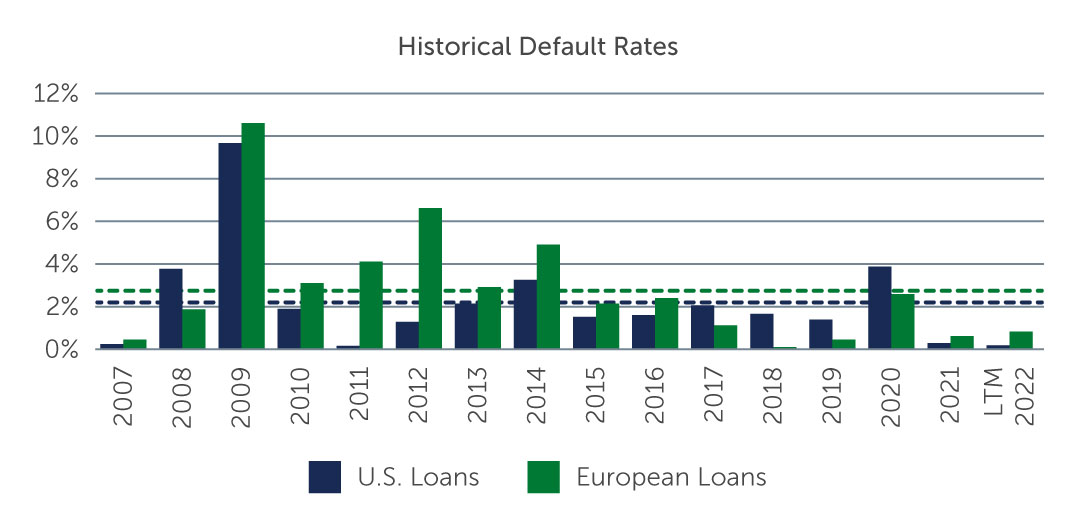

Against this backdrop, and given the dramatic moves in the market, there are certain areas that seem to be more than compensating investors for the fundamental risk they are taking. This is particularly true given that defaults in developed markets are expected to remain below long-term historical averages this year, supported by the fact that only a very small portion of the market is trading at stressed levels.

Figure 1: Defaults are Expected to Remain Below Long-Term Averages

Sources: S&P/LSTA Leveraged Loan Index; S&P European Leveraged Loan Index. As of February 28, 2022.

Opportunities Across the Market

In the current environment, we believe high yield offers a number of potentially attractive opportunities.

A Compelling Case for Loans

In a rising-rate environment, floating rate assets such as loans look attractive, particularly in the U.S. given the strong economic backdrop and relatively lower exposure to Russia. The interest rate on a loan typically resets every three months, in line with changes in market interest rates, meaning loans can provide a hedge against rising rates. Additionally, because loans are senior in the capital structure, they are paid back ahead of subordinated debt and equity and tend to be secured by some or all of a borrower’s assets, providing further credit protection potential. As we look at the market today, we believe there is an interesting opportunity in loans, for a number of reasons:

- A large portion of the senior secured loan market has a low base rate floor, meaning a significant portion of the asset class is or will become truly floating rate—offering a higher coupon payment—in a much shorter time frame than was the case during the last rising-rate period.

- Corporate fundamentals, overall, remain strong, and current loan spreads appear to be fairly compensating investors in the context of defaults.

- Loans are poised to benefit from a technical tailwind due to increased demand for the asset class heading into a rate-hiking cycle.

Bonds: Shorter-Duration Fixed Rate

Global high yield bonds also look relatively well-positioned in today’s environment. While they are fixed rate assets, the market has a duration of roughly 3.7 years, compared to 7.2 years for investment grade corporate bonds.3 As a result, even in periods of rising U.S. Treasury yields/interest rates, high yield returns have only been marginally impacted, while longer-duration asset classes have tended to sell off more aggressively. It is also worth noting that from a ratings standpoint, in the European bond market in particular, there has not been much difference in the performance of BB, B, and CCC-rated bonds—partly because investors are still searching for yield. While we believe there is attractive long-term relative value to be found in lower-rated credit, particularly through fundamental, bottom-up credit selection, it could be prudent to reduce exposure in the riskier parts of the market given the potential headwinds facing many corporates as we move through 2022 and in to 2023.

New Issues

With the market and overall sentiment a bit weaker, the pipeline for new issuance of high yield bonds almost shut down in Europe and slowed to a trickle in the U.S. However, there is a significant amount of underwritten leveraged buyout (LBO) debt sitting on banks’ balance sheets today. In the coming months, if things stabilize, the new issue pipeline could start to flow again, resulting in favorably priced opportunities in this market.

Positive But Cautious

Our outlook for the market is positive, if a little more cautious, than it was at the start of the year. Given the ongoing risks, we are likely to see further volatility across the market. For active, bottom-up managers, these periods of transition and volatility often result in opportunities to generate alpha—as we have seen through multiple market events, including the COVID selloff. However, a focus on fundamentals and bottom-up, credit-by-credit analysis is critical, as it can help managers capitalize on relative value opportunities as they arise while also avoiding unwanted risks.

1. Source: ICE Bank of America, Credit Suisse. As of March 31, 2022.

2. Source: J.P. Morgan; Wells Fargo, Haver Analytics. As of August 2021.

3. Source: ICE Bank of America. As of February 28, 2022.