The Opportunity in the Energy Transition

When it comes to combating climate change, Clive Burstow discusses why natural resources companies are part of the solution—not the problem.

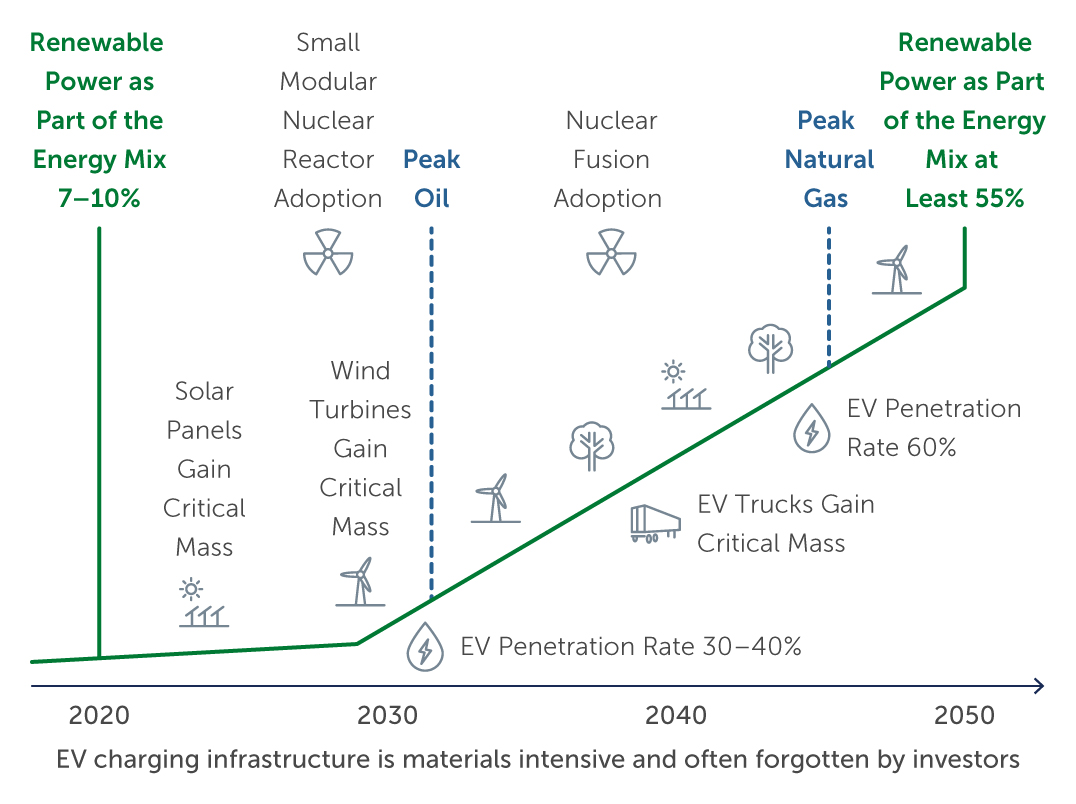

The energy transition is essentially the decarbonization journey required to achieve Net Zero by 2050. In other words, it is taking the global power matrix, which we have spent 100 years designing to run on fossil fuels, and switching at least 55% of it to run on renewable power by 2050 (Figure 1). While we believe that this is achievable, there is a challenge—it will require us to consume significantly more amounts of commodities, which are currently in structural deficit, with very little chance of closing that deficit over the next 30 years.

Figure 1: The Energy Transition

Source: Barings. As of April 2022. Based on a Safety4Sea diagram. For illustrative purpose only.

A key driver of commodity demand

De-carbonization is incredibly materials and energy intensive, and it comes at a price and at an increased amount of commodity demand. For instance, the 55% renewable energy target by 2050 is mainly going to be made up of solar and wind energy. For every gigawatt of offshore wind power generated, you need five times more steel, and 15 times more copper than an onshore fossil fuel plant generating the same amount of power.1 And when it comes to electric vehicles, they consume up to 100 kilograms of copper per vehicle (around 80% to 85% in the car itself, and another 15% to 20% on top for the charging infrastructure). This is five times more intensive in terms of copper demand than an internal combustion engine.2 As a result, ‘going green’ requires us to consume more commodities than we've consumed in the last 30 years—and this is key driver for the resources sector over the next three decades.

There is also a cost of going green by 2050—and it’s inflationary. The total estimated cost in terms of total investment needed to achieve Net Zero is between US$55 trillion and US$60 trillion.3 This is around 2.5 times the size of the U.S. economy and around three times the size of the Chinese economy in 2021. At its peak, we'll be spending about 2.5% of global GDP, or around US$3 trillion, a year to achieve Net Zero. But there's also a cost to not doing it. If no action is taken by 2030, according to some estimates, the impact of climate change on U.S. GDP could be 1% to 1.5% of current GDP per year.4

Challenges facing the energy transition

When looking at supply versus demand for commodities going forward, it is clear that a number of commodities are in structural deficit today. According to our internal five-year projections, for instance, we can see that by 2026, aluminum will be around nine million tons in deficit, and copper around four million tons.

Adding to the challenge is that climate-mitigating solutions take time. For example, the largest copper mine ever built took about 10 years from discovery in 1990 to first production in 2000. Four of such mines are needed to bridge the gap just to get to 2026.5 Despite technological improvements to speed up the process, even if four of these mines are started up today, it will only be around 2030 before we see first production. And further exacerbating the problem is that it can take up to 10 years to put in permitting to get the mine through.

Accessing the opportunity

Now, it's not all doom and gloom. We believe that there is a way of bridging some of this gap—but according to our analysis, higher prices will be needed to incentivize new supply, which will allow the Net Zero target to be reached. This is important because it suggests the potential for stronger returns for companies with exposure to commodities, while allowing them to build new mines and expand their production. This is true for a range of commodities, not only the traditional ones. For example, take a solar cell or an offshore wind plant. There is an array of commodities that are used to make this renewable energy infrastructure—including steel, cement, glass and even chemicals like polypropylene—and ramped up production is required for all of these materials, which are critical to the energy transition.

What does this mean for the investment opportunity in this sector? In our view, these companies should not be thought of in terms of energy and mining companies—rather, as enablers and generators of the energy transition. We believe investing in both the enablers of the energy transition, as well as the generators of renewable energy, allows investors to capture both sides of the value chain and unlock value in good companies. For instance, certain mining companies which produce commodities that are critical to the energy transition, and energy companies with focused on providing ‘energy transition commodities’, are likely beneficiaries of the structural theme. In particular, oil & gas companies are part of the solution to climate change. A number of oil companies are generating significant amounts of cash flow, which has been rotated into renewable power. And we're seeing more and more companies in the industry pivot toward this and drive the clean energy transition—this is where we believe there is potential to unlock hidden value.

Key takeaway

The energy transition is a theme that is here to stay, and we believe it will likely be a multi-decade investment opportunity. But there is no clean energy without natural resources. While there are indeed ‘bad actors’ across the resources industry—in terms of companies with poor Environmental, Social and Governance (ESG) practices like high carbon emitters—there are also a number of good companies with positive or improving ESG standards. In particular, we see value in investing in these natural resources companies, which are well run, with strong balance sheets and solid asset bases, and with a positive commitment to ESG. By doing so, we believe there is the opportunity to promote further positive change and drive the transition to a more sustainable world.

1. Source: Barings, ArcelorMittal, Deutsche Bank. As of June 2022.

2. Source: Barings, Deutsche Bank. As of June 2022.

3. Source: Barings, World Economic Forum. As of July 2021.

4. Source: Barings. As of April 2022.

5. Source: Barings, Deutsche Bank. As of April 2022.

22-2435443