How Life Insurers Account for Realized Losses May Cause Unnecessary Pain

An accounting method long used by life insurers has come under pressure amid rising rates and wider credit spreads, potentially setting the life insurance industry up for large unrealized losses. But there may be a solution.

Life insurers have long used an Interest Maintenance Reserve (IMR) to adjust liabilities for unrealized gains and losses on the asset side of their balance sheets. This has worked well during periods of falling rates, resulting in increased gains. But with the recent double-whammy of rising rates and wider credit spreads, the mechanism is faltering. As IMR diverges from economic reality, it is time for it to be fixed.

IMR has Worked Well Historically…

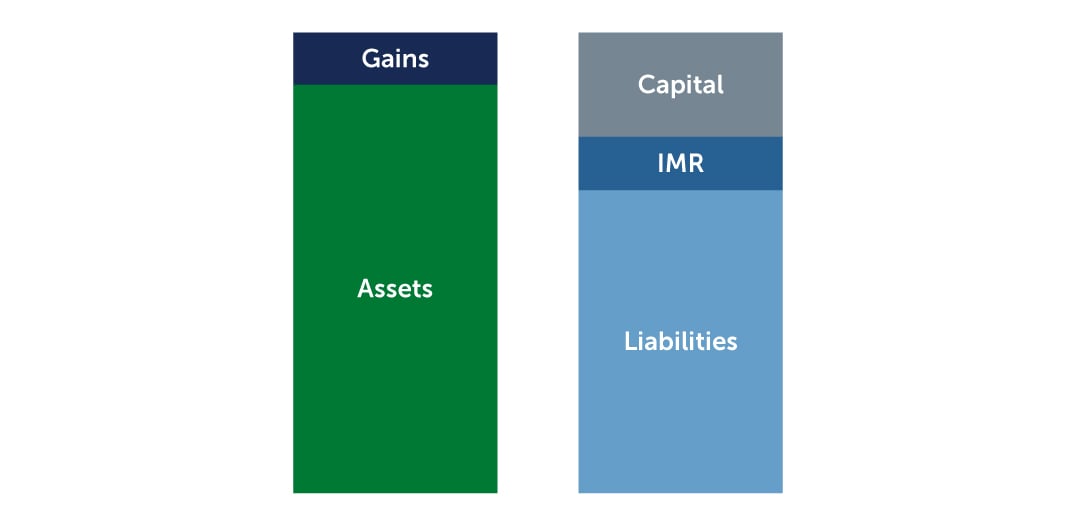

In the IMR, statutory accounting for life insurance captures realized gains and losses, net of tax. As the asset side of the book-valued balance sheet inflates due to gains taken, this reserve increases the liability side, effectively maintaining the current capital position of a company. The IMR amortizes over time at a pace dependent on the remaining maturity of the sold securities that created the gains, and this amortizing reduction in IMR ultimately becomes investment income. In this way, net investment income is largely immune to volatility driven by realized gains and losses.

Figure 1: IMR on the Balance Sheet

Source: Barings.

Source: Barings.

IMR has worked well since its inception in 1992 as interest rates have generally fallen during this period, and fixed income investments have increased in value. Namely, unrealized gains for the industry have been robust, and portfolio trading has resulted in realized gains, replenishing levels of IMR that supplement investment income over time.

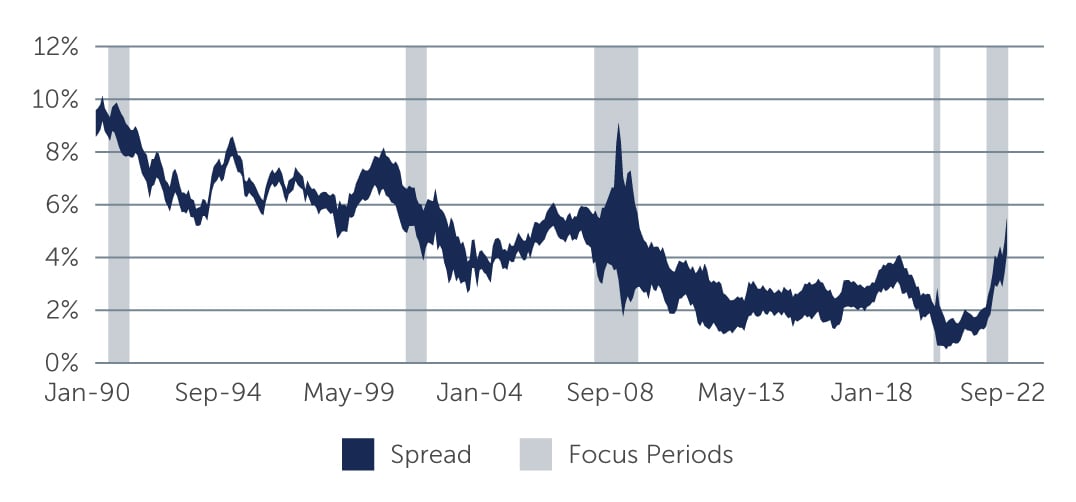

Figure 2: Historic Spreads and Yields for Broad Market Single-A Corporates

Source: Bloomberg. As of September 30, 2022.

Source: Bloomberg. As of September 30, 2022.

… But is Faltering Amid Rising Rates & Wider Credit Spreads

Recently however, amid decades-high inflation and contractionary monetary policy enacted by the U.S. Federal Reserve, interest rates and credit spreads have uncommonly risen together in dramatic fashion, swinging the life insurance industry’s unrealized gain position to a large unrealized loss. The Corp A-rated index, a rough proxy for insurance bond portfolios, has fallen 17.9% in the first three quarters of 2022. This is the largest three-quarter drop recorded since index inception in 1998. Excluding the three quarters trailing Q2 2022 (-13.4%), the next largest drop was -11.6% during the Great Recession in 2008, as Treasury rates fell sharply and spreads widened considerably.1

1. Source: Bloomberg. As of September 30, 2022.