High Yield: When Technicals Create Opportunity

Challenging technical conditions have caused high yield spreads to widen beyond what fundamentals would suggest, potentially setting the stage for strong performance in loans and senior secured bonds, in particular.

As hawkish central banks attempt to rein in decades-high inflation, and the ongoing war in Ukraine continues to drive further uncertainty around food and energy prices, it’s been an especially volatile period for markets. Coupled with increasingly mixed economic data, these risks are driving increased investor speculation about an economic “hard landing” and recession. Like virtually all other asset classes, high yield has not been immune, with higher interest rates and spread widening leading to negative returns in the second quarter. However, with relatively high-income potential and a still-solid fundamental backdrop, we see room for positive performance once the market finds its footing.

Technicals are Overpowering Fundamentals …

The technical backdrop has become more challenging for high yield as market sentiment has grown increasingly negative amid escalating concerns of a recession. While negative high yield performance in the first few months of the year largely reflected higher interest rates, this picture has now materially changed, with significant spread widening amid increasing economic growth concerns. This widening has been exacerbated by more challenged liquidity conditions and moderate outflows. On the loan side, in particular, there has been a lack of new collateralized loan obligation (CLO) issuance, which has historically accounted for a large portion of loan demand.

Despite these significant technical pressures, it’s important to realize that underlying corporate fundamentals remain quite strong. Company earnings and cash flows, in many cases, have returned to or surpassed 2019 levels. This has in turn led to record margins, with many companies still able to pass inflationary pressures through to the consumer. Additionally, many high yield issuers took advantage of previously healthy capital markets to refinance debt, reducing coupon payments while also extending maturities. While the fundamental picture will likely deteriorate the longer inflation remains elevated and as financial conditions tighten, companies are entering this challenging period from a strong starting point. In fact, it is highly unlikely that defaults will reach levels that current credit spreads are beginning to imply. In fact, we believe that making reasonable default projections under a recession scenario suggests that there is still significant excess spread, or liquidity premium, being offered to investors.

… Potentially Giving Way to Attractive Opportunities

The income element of high yield bond and loan returns means that even if spreads remain at these historically wide levels, the asset class could potentially generate attractive returns over the next 12 months. And in the case of loans, in particular, with significant rate rises expected through the remainder of the year, that income element is likely to increase to around 8% by the end of the year. Against the backdrop of macro uncertainty and the broad-based sell-off in recent months, we do have a slight bias for the higher rated part of the market—although we believe there is value to be found across the rating spectrum through detailed bottom-up analysis.

Loans

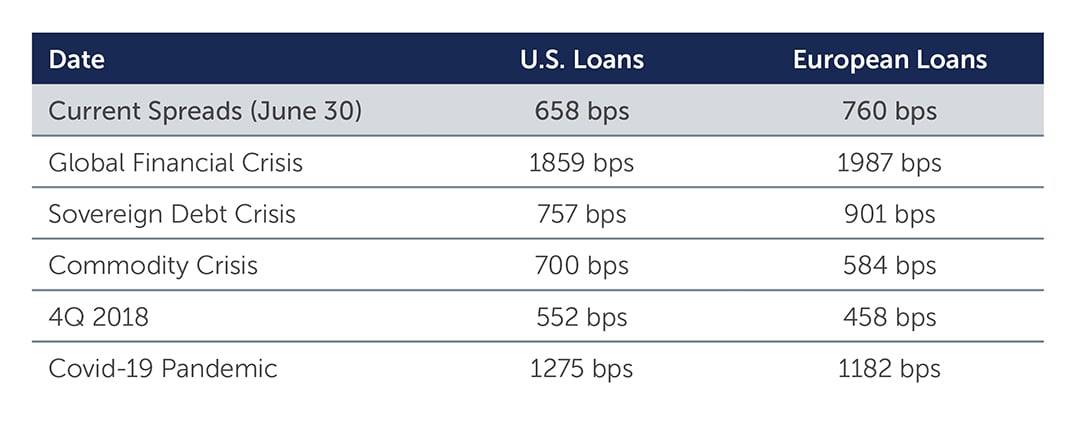

We also see opportunities in segments of the market where technical pressures have caused spreads to widen beyond what fundamentals would suggest. Senior secured loans, in particular, present a compelling opportunity. While loans showed resilience in the early months of the year, they are no longer immune to the broader volatility. At the same time, the asset class has experienced moderate outflows from certain investor bases given their significant outperformance in the earlier part of the year. This dynamic, coupled with the dearth of CLO demand, has caused spreads to widen 150–200 basis points (bps) in a six week period—to levels not seen since the financial crisis, sovereign debt crisis, and early part of the pandemic (Figure 1).

Figure 1: Spreads vs. Historical Widening Events (bps)

Sources: Barings and Credit Suisse. As of June 30, 2022. U.S. loans represented by Credit Suisse Leveraged Loan Index. European loans represented by Credit Suisse Western European Leveraged Loan Index non-USD denominated). (Spreads represented by 3-year discount margin.

Sources: Barings and Credit Suisse. As of June 30, 2022. U.S. loans represented by Credit Suisse Leveraged Loan Index. European loans represented by Credit Suisse Western European Leveraged Loan Index non-USD denominated). (Spreads represented by 3-year discount margin.

This is despite the fact that loans are secured by some or all of a borrower’s assets, which provides investors with additional credit risk protection as secured loans typically have first-priority claim on a borrower’s assets in the event of default. While this characteristic has been less of a focus in recent years, as default rates globally have trended very low, it can provide substantial downside protection as defaults begin to rise. Loans are also senior capital structure, which means the loan’s interest and principal payments must be paid before other creditors receive payment. Finally, loans provide a floating-rate coupon payment, which in a rising interest rate environment can provide steadily increasing income as interest payments adjust higher with rates.

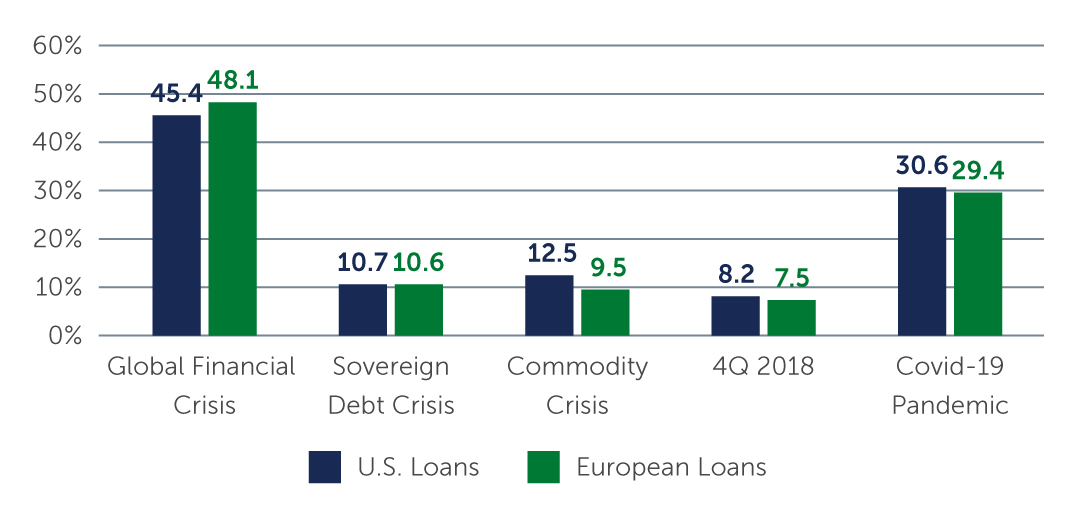

With all of these positive attributes, including the strong fundamental backdrop, currently outweighed by technical pressures, we believe this space is positioned to deliver attractive returns over the next 12 months—as it has historically when spreads have reached these levels (Figure 2).

Figure 2: 12-Month Return After Spread Widening Event (%)

Sources: Barings and Credit Suisse. As of June 30, 2022. U.S. loans represented by Credit Suisse Leveraged Loan Index. European loans represented by Credit Suisse Western European Leveraged Loan Index non-USD denominated). (Spreads represented by 3-year discount margin. Returns are hedged to USD and for the twelve month period following the widest daily 3-year discount margin. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Sources: Barings and Credit Suisse. As of June 30, 2022. U.S. loans represented by Credit Suisse Leveraged Loan Index. European loans represented by Credit Suisse Western European Leveraged Loan Index non-USD denominated). (Spreads represented by 3-year discount margin. Returns are hedged to USD and for the twelve month period following the widest daily 3-year discount margin. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Senior Secured Bonds

High yield bonds, too, are beginning to price in very negative news, potentially providing attractive upside given lower dollar prices and reasonable coupon rates. Senior secured bonds, in particular, can provide an attractive way to invest in the high yield markets. Like loans, they also benefit from security interests in various firm assets, which means that if a company defaults on its debt obligations, senior secured bondholders are first in line for any repayments, in priority over unsecured bondholders.

Recently, as a result of the sharp move higher in bond yields, the senior secured bond market has been trading at a considerable discount to par. Yields for the senior secured bond market have increased as a result, and are now approaching 9%.1 In our view, this combination of higher yields with materially discounted bond prices is an ideal environment in which to drive attractive total returns.

Looking Forward

Looking ahead, while a mild recession may be in the cards, a recurrence of a 2008-type of event that spreads are beginning to price in doesn’t seem likely. Employment remains particularly strong, and corporates are entering the coming months from a position of strength with record levels of liquidity on balance sheets. Given the level of correlation in negative asset returns over the last several months, it is clear that investors are taking a pause from most risk assets. However, we are reaching the point where investors can find good quality high yield investments at attractive prices. That said, particularly during periods of uncertainty—and with further volatility likely going forward—active management and bottom-up credit selection remain key to both capitalizing on opportunities and avoiding additional downside.

1. Source: ICE BofA BB-B Global High Yield Secured Bond Index. As of June 30, 2022.

22-2279251