CLOs Well-Positioned Amid Rising Rates, Heightened Uncertainty

In the context of a thin new issue pipeline, secondary market CLOs look more interesting, on balance, relative to new issues.

Risks for fixed income markets significantly increased in the first quarter with Russia’s invasion of Ukraine, higher inflation and U.S. Federal Reserve (Fed) rate hikes. While most CLO managers have little direct exposure to the Russia/Ukraine conflict, the market is not immune to macro-level volatility, and spreads widened across all parts of the CLO capital structure, with the most notable moves occurring in the secondary market. That said, relative to other asset classes, CLO spreads held in fairly well, and the asset class remains on solid footing overall. AAAs, AAs and single-A tranches returned -0.26%, -0.33% and -0.54%, respectively. BBB, BB and single-B tranches returned -0.01%, -0.33% and 1.42%.1

Supportive Technicals

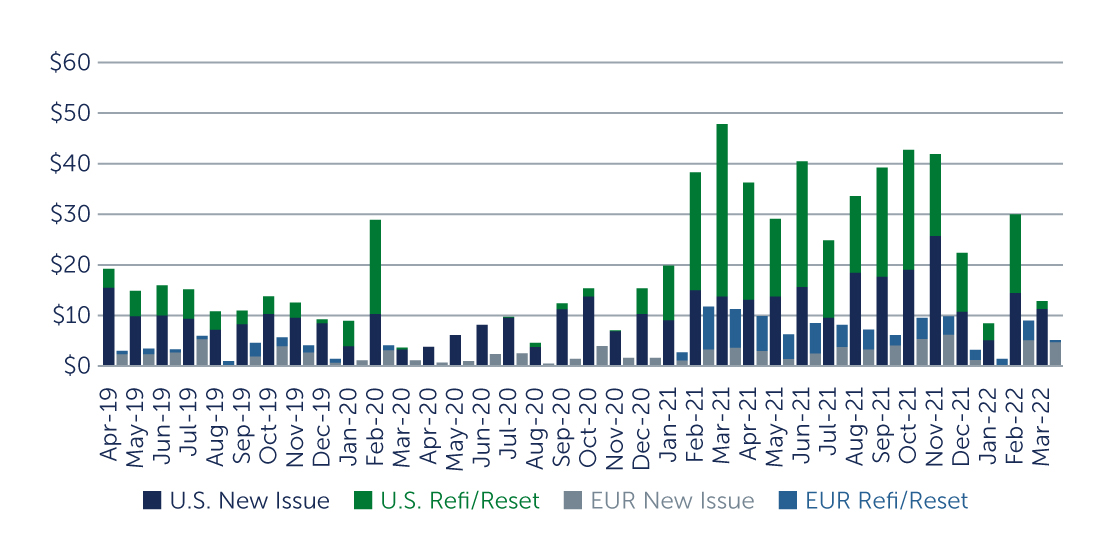

Part of the reason spread widening was relatively contained was because of the more supportive technical picture in the asset class. After record levels of issuance last year, new issuance in the first quarter was down roughly 50%, reaching $49 billion in the U.S. market and €14.6 billion in Europe. The Libor-SOFR transition certainly played a role—issuance was slow to start the year as market participants waited for the specifics of the transition to be worked out, such as what the difference in pricing would be between LIBOR and SOFR-based liabilities. While the transition went fairly smoothly and was largely worked out by month-end, Russia’s invasion of Ukraine caused spread widening, which once again put new issuance on pause. That said, given the improvement in loan prices since mid-March, new issuance may pick back up again in the weeks ahead, particularly if CLO liabilities begin to stabilize.

Figure 1: Issuance Was Slow To Start the Year

Source: J.P. Morgan. As of March 31, 2022.

As volatility returned to the market in late February, AAA tranches felt the greatest impact as investors looked to sell high-quality assets in favor of raising cash—in one day alone, there was nearly $1 billion of AAA CLOs in the market.2 However, trading never seized up completely, and even on the most challenged trading days, liquidity remained decent. Further down the capital structure, there was also a good amount of discipline among BB holders as the market traded off. Sellers acted in an orderly fashion overall, underscored by the fact that a majority of BB bid lists had at least a portion of do not trade (DNT) bonds—meaning the best bid from a potential buyer did not meet the reserve level of the seller. In most cases, sellers chose not to trade rather than trying to sell at fire sale prices.

Secondary vs. New Issue

In the context of a thin new issue pipeline, we believe the secondary market for both AAA and mezzanine deals looks more interesting, on balance, versus the new issue market. Interestingly, this is almost purely a matter of price. Whereas new issues are generally coming to market at or near par, the secondary market is offering opportunities with anywhere from three to five points of discount, even for deals that are well-performing. Assuming that discount can be monetized as the dislocation in the market normalizes over the medium to longer term, the total rate of return for buying a deal in the secondary market, versus buying a high-coupon deal at 99 or par in the new issue market, is potentially greater. Further supporting the case, the differential between Libor and SOFR-based liabilities has widened on the back of the broader market volatility, from roughly 10 basis points (bps) at the start of the year to 34 bps at the end of the quarter—meaning a secondary deal that is Libor-based is paying more coupon today.3 As a result, faced with buying a new issue at par or looking to the secondary, many buyers are gravitating toward the latter.

Looking Ahead

As we enter a time when ratings agencies might turn a more keen eye toward downgrades, CLO portfolios look well-positioned versus 12–18 months ago. The more benign markets of last year facilitated the re-positioning of many portfolios, and CCC exposures are down fairly significantly across the board. This suggests that any downgrades going forward will not necessarily lead to sudden cash diversions within CLO structures. At the same time, the default outlook for the leveraged loan market for the next 12 months looks stable, with defaults expected to stay below long-term historical averages in the near term.

Looking ahead to the coming months, given that liability spreads are wide, very few deals are likely to get called or potentially even refinanced in the near-term—and as deals stay out longer, the potential for tail risk increases. In terms of risks we’re watching, Russia’s war in Ukraine is certainly a big one, as is its impact on economic growth, particularly in Europe. There also seems to be an increased risk of stagflation—an inflationary environment paired with weak economic growth. While companies have largely been able to pass higher costs on to consumers, it’s not clear how much longer that can continue. A final factor we’re watching, and that could significantly impact the CLO market going forward, relates to S&P’s proposal to update its capital model as it relates to insurance companies.

Nonetheless, we believe there is still value to be had in CLOs. Relative to similarly rated investment grade and high yield corporate credit, for instance, CLOs not only offer the potential for considerable incremental yield, but also—given their floating-rate coupons—can provide stability during periods of rising rates. However, careful, bottom-up credit and manager selection are key, both to selecting the right opportunities and avoiding unnecessary risks.

1. Source: J.P. Morgan CLOIE Index. As of March 31, 2022.

2. Source: Based on Barings’ market observations.

3. Source: J.P. Morgan. As of March 31, 2022.