Five Reasons Private Assets May Offer Shelter from the Storm

Given the challenges in today’s market, private assets can offer a number of advantages—from diversification, to stability in a rising rates and inflationary environment, to a potential illiquidity premium.

There is no shortage of risks facing investors today: a war in Ukraine, rising interest rates and the highest inflation in four decades, among others. Public markets have experienced a surge in volatility in response, and in some segments, an outflow of assets. While private markets have not been completely insulated from these developments, institutional investors have continued to find value in private assets—from corporate direct lending and infrastructure debt, to commercial real estate debt and private asset backed securities.

In particular, there are five reasons we believe private assets may be worth consideration in today’s environment.

1. Greater Diversification

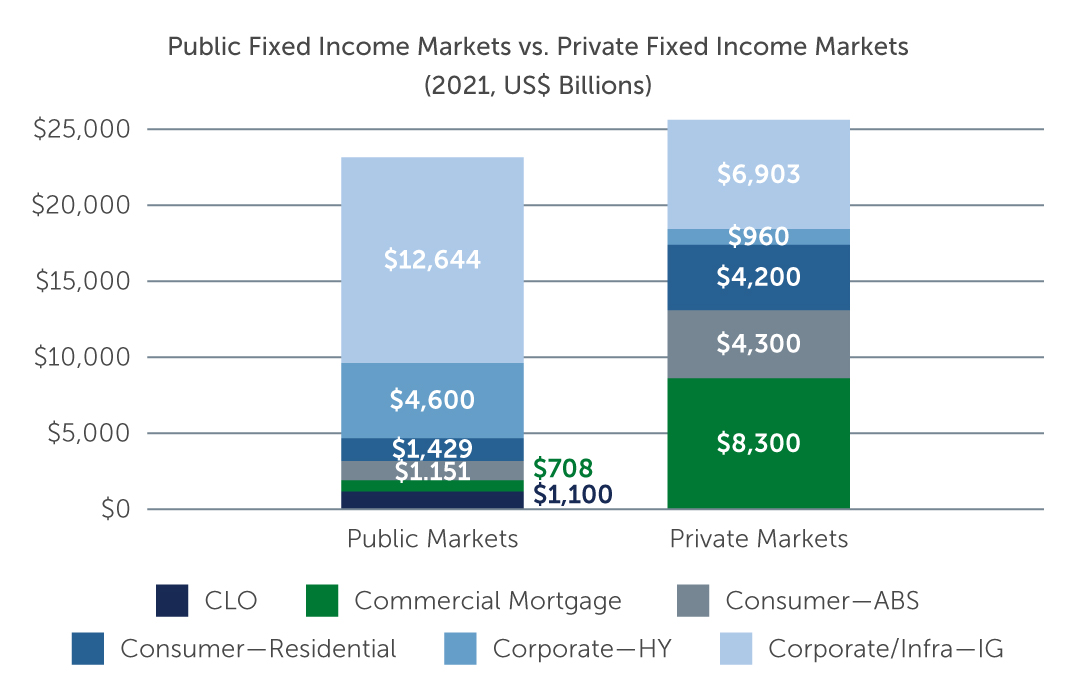

While public markets have long comprised a wide range of asset classes, which has facilitated diversification, in private markets, the range of assets has continued to expand. For example, in private debt alone, three primary risk buckets have historically predominated: direct lending, real estate and infrastructure. But in recent years, opportunities have emerged in areas like consumer finance—including student loans, residential loans, and consumer loans. In addition, in the corporate arena, asset classes such as fleet financing investments are increasingly available. This growth has resulted in a much broader selection of asset classes available to private debt investors, potentially providing greater diversification and risk-mitigation benefits than in the past.

The diversification benefits offered by private markets are further enhanced by the way in which private assets are valued and priced. In public markets, asset values fluctuate daily and often in an exaggerated way, even in response to events that may have little impact on an issuer’s ability to repay its debt. With private assets, values tend to be more stable, although they do move in response to changes in interest rates or underlying credit fundamentals. The different manner in which private assets move relative to public assets provides a level of diversification beyond the different asset classes that are now available, and further contributes to private assets’ effectiveness in mitigating risk.

Figure 1: A Larger, More Diverse Private Market Source: Bloomberg, Barclays, Credit Suisse, Mortgage Bankers Association, Urban Institute, Barings estimates. Totals do not include government bonds or traditional bank lending.

Source: Bloomberg, Barclays, Credit Suisse, Mortgage Bankers Association, Urban Institute, Barings estimates. Totals do not include government bonds or traditional bank lending.

2. Potential Illiquidity Premium

Another attraction of private markets is the opportunity to earn a return premium over public market assets. This premium comes largely in exchange for giving up short-term liquidity.

Historically, this premium has been driven primarily by fluctuations in the public market rather than private market pricing, as some might expect. Private market investors and issuers tend to be longer-term in focus than public market investors, which gives them an ability to look through short periods of volatility. As a result, the coupons and spreads that private market investors demand—and that issuers are paying—tend to be more stable. As we saw in 2020-21, spreads in public markets widened dramatically, reducing the illiquidity premium offered by private assets. However, as public markets returned to normal, that premium was restored. Throughout that period, private assets remained relatively stable.

This relative stability also speaks to the fact that private assets come with additional avenues for mitigating risk. During the pandemic, even in the public markets, defaults were quite low, but in private markets additional factors were at work. First, because of the close relationship that typically exists with the lender, there is a degree of flexibility for lenders and borrowers to work together to find a solution that preserves value while helping to avoid defaults and bankruptcies. With public assets, bankruptcy proceedings come with court-imposed timelines; with private assets, arrangements or restructurings can often be worked out more easily, especially since fewer parties tend to be involved. Second, with private assets, loan structures may be customized in a way that minimizes the chances of loss for the investor. Over time, the combination of these factors may result in lower losses—an added benefit to the potential illiquidity premium on offer.

3. Stability in a Rising Rates & Inflationary Environment

In both public and private assets, floating-rate loans are a common means of mitigating the effect of rising interest rates and inflation—and private markets, in particular, are heavily floating rate. The corporate direct lending market is almost all floating rate, for instance, as is the non-core segment of the commercial real estate sector. The asset-backed and residential finance markets are also predominantly floating rate.

As for inflation, real estate is a widely accepted hedge. In the public markets, commercial mortgage-backed securities (CMBS) are one means of getting that exposure. However, in public markets that hedge can be eroded somewhat as the available commercial mortgage assets for securitization tend to be smaller and lower in quality than private market commercial mortgages. Commercial real estate owners have a preference for private market transactions because of the simplicity and flexibility of working with smaller lending groups, sometimes a single lender. In addition, in private markets, investors have more flexibility to obtain the duration they want in order to manage their interest rate risk. In public markets, influencing deal structures is typically only possible for the very largest investors in the market and even then that flexibility has limits.

4. Attractive Opportunities, Facilitated by Origination

As we noted above, the opportunity set in private assets is broader today than in the past. Looking across the markets today, one asset class that looks attractive is commercial real estate debt—both core plus and value add—where the illiquidity premium is potentially significant. Yields on these mortgages can be noticeably higher than on comparable corporate debt. For example, assuming core mortgages are comparable to AA corporate debt, core-plus mortgages are comparable to BBB debt, and value-added mortgages are comparable to BB debt, spreads in each of these categories can be higher by 100 to 150 basis points (bps). Adding to the appeal is conservative deal structuring that provides robust investor protection. The long duration offered by these assets is also a benefit in a world in which duration is scarce.

We also see value in direct lending, particularly in the European market. Although the economic outlook is somewhat cloudier than in the U.S. market, borrowers in Europe tend to use less leverage, and spreads are typically a little wider. In addition, certain markets, such as France and the U.K., offer greater creditor protections from a regulatory standpoint. For U.S. investors, there may also be an opportunity to pick up additional yield by hedging back to the dollar.

That said, the ability to capitalize on these opportunities can be affected by the ease with which a manager can access them. Indeed, the ability to access attractive opportunities across private markets and construct multi-asset private market portfolios depends heavily on a manager’s origination capabilities. Private investments cannot be bought off of exchanges. Rather, they must be directly originated. And managers must have relationships in place—with private equity sponsors, banks and borrowers—in order to become a preferred partner when it comes to financing and gain access to a pipeline of future deals.

Underscoring the importance of origination, many managers in recent years have begun to acquire origination arms, or companies that make loans that the managers then have the option to buy. This can create a “flywheel effect” for the manager, essentially giving them access to deals that might otherwise be less readily available and enhancing their ability to construct multi-asset portfolios.

5. ESG: Greater Influence & Customization

Interest in environment, social, and governance (ESG) considerations has grown in recent years, and in the private assets arena, managers can have significant influence—although the way ESG factors are incorporated can vary considerably from asset class to asset class. In direct lending, for instance, one way managers can influence borrowers is through so-called “ratchet loans,” which offer a lower coupon rate in return for taking steps to address ESG goals that will bolster their financial profile.

In commercial real estate, the incorporation of ESG factors looks slightly different. On the value-add side, there is already a significant market for greener assets. This is partly because of the opportunity to “upfit” properties—for instance, a developer may buy property for US$100 million, and then invest another US$100 million in upgrades. And there are a number of incentives that encourage property owners to make these upgrades in a “green” way, from the potential to charge higher rents, to subsidies offered by local governments. Another difference with commercial real estate is the ability to quantify the impacts of the green improvements in terms of energy and water usage and the like, which can help to justify the cost.

What’s Next for Private Assets?

Private assets are becoming a larger part of institutional investors’ portfolios as their benefits have become increasingly evident. This move is also being driven by interest on the part of borrowers, who value the lender relationship, the customization, and the lower costs.

But the interest of institutional investors is driving another trend: manager consolidation. As institutional investors have ventured into more asset classes, the way they access those asset classes has changed. Whereas in the past exposure came primarily via funds or separately managed accounts, today it often involves limited partnerships. Managing these relationships, however, becomes geometrically more challenging as these investments proliferate.

Managers that offer multiple asset classes, therefore, are becoming increasingly attractive. Opting for a multi-asset manager not only simplifies the reporting process, it facilitates the management of private asset investments and streamlines the investment process. That is, with one manager, there is less need to get approval from the investment committee for every investment decision. In addition, deployment of capital is expedited. Historically, the performance of private assets could be described by a j-curve in which returns might not be evident for years, hindering the redeployment of capital. With a multi-asset manager, the investor enjoys a greater ability to deploy and re-deploy assets.

The bottom line for institutional investors: given the current challenges in today’s market, private assets can offer a number of advantages. Not only do these assets tend to be more stable, providing enhanced diversification benefits, they often offer an attractive illiquidity premium—and these benefits are available across an ever-widening variety of asset classes.

This piece is based on a recent episode of Streaming Income. Listen to the full podcast conversation here.