From Rates & Inflation to ESG: What’s Next for IG Credit?

Despite heightened risks, IG corporate bonds remain supported by an improving economy and robust corporate fundamentals.

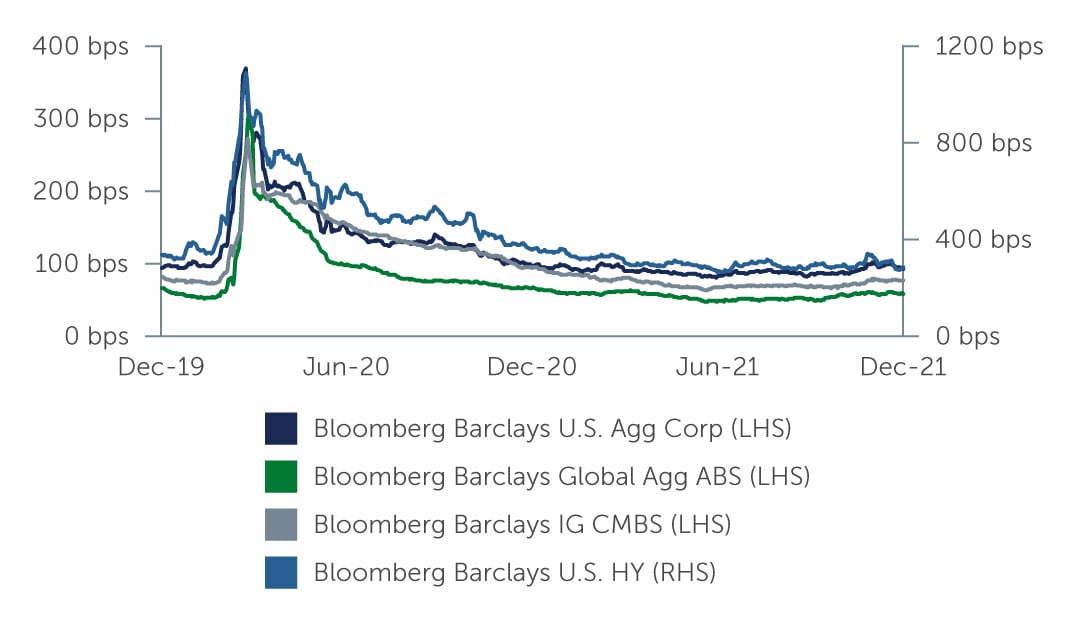

Investment grade (IG) credit markets experienced increased volatility in the fourth quarter as investors faced a number of concerns, from the Omicron variant, to the U.S. Federal Reserve’s (Fed) announcement that it would taper its asset purchase program more quickly than anticipated. Still, there was good news to be found. Most companies reported positive earnings for the third quarter, with many beating expectations, while data also demonstrated that overall economic conditions remained fairly strong. Accordingly, IG corporate credit was up slightly at the end of the fourth quarter, returning 0.23%.1 Although spreads widened to finish the year at 92 basis points (bps), they still appear tight relative to historical levels.

Figure 1: IG Spreads Remain Tight Historically

Source: Barings. As of December 31, 2021.

Improving Fundamental Backdrop

Despite heightened risks facing the asset class, the fundamental backdrop remains solid. For many companies, revenue and EBITDA are above their pre-COVID levels. On a year-over-year basis, average revenue for the U.S. IG corporate universe was up 12%, and EBITDA had increased by almost 19%.2 Company margins have also improved. While there is some concern about the impact inflation will have, companies have generally been able to pass through those higher costs to customers—albeit with some dispersion across companies and sectors. At the same time, IG issuers across the board are continuing to pay down debt. After peaking at 3.3x in the third quarter of 2020, gross leverage returned to 2.9x in the third quarter of 2021—the same level seen at year-end 2019.3

From a technical standpoint, robust new issuance early in the quarter continued to test the depth of buyer demand, which remained strong, before issuance slowed in the final weeks of the year. After having been positive for the majority of the year, fund flows were more mixed toward the end of 2021. However, with rate rises on the horizon this year, we will likely see a return of foreign demand back into U.S. corporate credit.

Energy Companies, EMD & ESG Bonds

Given the positive fundamental backdrop, we expect to continue seeing select opportunities emerge across key areas. One area in particular is in companies that are upgraded from high yield to investment grade. After a number of companies were downgraded last year following the onset of the pandemic, some of them have taken material steps to lower their leverage, and now look poised to make the transition back. We expect to see more of these so-called “rising stars” emerge in the coming months.

We also see value in the energy and commodity space, where many companies have benefitted from improved margins on the back of higher commodity prices. Commodity companies have also been very disciplined with their capital expenditures, which have fallen in recent months. On the other hand, capital expenditures for non-commodity companies have actually risen by 8%—which suggests that these companies are compensating for wage inflation and goods shortages.4 We also continue to favor the financials sector. We see opportunities within the insurance industry, particularly with life insurance and property & casualty companies, as well as in banks, which we believe are in good shape financially.

In today’s low-yielding environment, and with rate rises expected this year, there are also potential benefits to looking beyond traditional IG corporate bonds. For example, collateralized loan obligations (CLOs) provide built-in protection from interest rate risk by virtue of their floating rate coupons, in addition to diversification benefits and strong structural protections. We are also seeing select opportunities in the emerging markets (EM) debt space, which is shorter in duration than developed market corporates and tends to trade wider given the idiosyncratic risks that exist across the EM landscape.

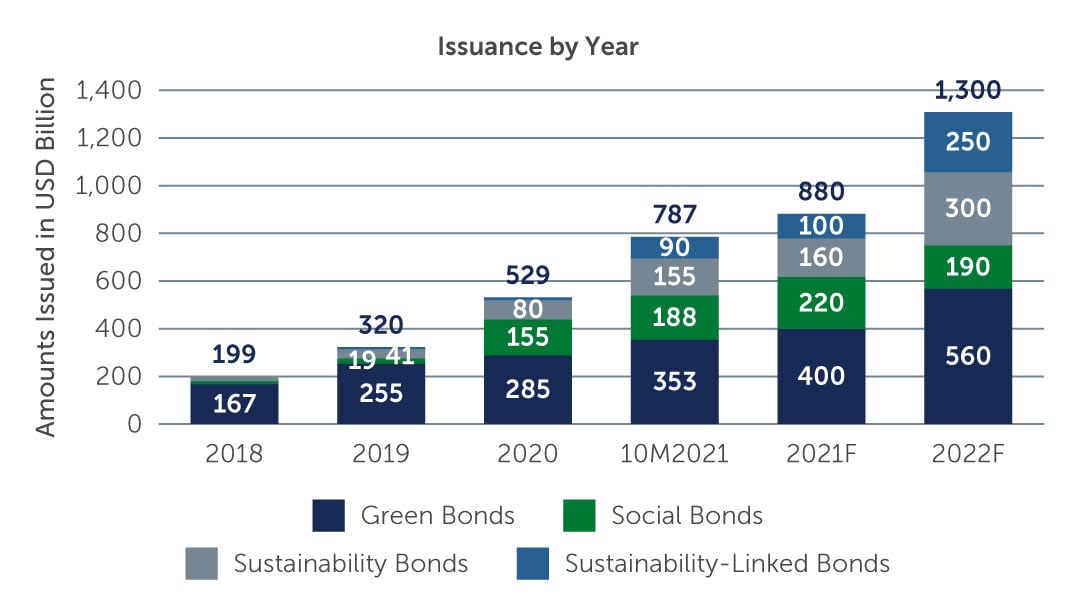

Elsewhere, we believe ESG-labeled bond issuance will continue to grow from 2021’s watershed levels, and could exceed $1.3 trillion this year.5 Given that environmental, social and governance metrics tend to be widely available and fairly comprehensive for IG corporates, we expect to see an increase in investment grade ESG bond supply as well. As ESG bond issuance continues to increase, managers that fully integrate ESG analysis into their investment process, and are able to show ESG reporting at a portfolio level, will likely be at an advantage.

Figure 2: ESG Bond Issuance May Reach $1 Trillion in 2022

Source: Climate Bonds Initiative, Unicredit.

Looking Ahead

As we look ahead to the coming months, rates certainly remain top of mind. While this may cause short-term pain for IG corporates, higher rates in the longer-term would not be an entirely unwelcome event. In a yield-starved world, and with IG spreads hovering around historically tight levels, some large institutional investors have been forced to consider allocations to lower-rated, higher-yielding asset classes. Higher rates, and a widening of spreads toward more average levels, could effectively bring some of that demand back.

Against the backdrop, we believe there are benefits to short-duration strategies, as well as multi credit strategies that can invest across the entire IG universe. Multi credit strategies are benchmark agnostic, meaning managers have the flexibility to pursue the best global relative value across asset classes, sectors and geographies—resulting in a diversified approach to credit that can potentially deliver more attractive risk-adjusted returns over time.

1. Source: Bloomberg Barclays. As of December 31, 2021.

2. Source: J.P. Morgan.

3. Source: J.P. Morgan. As of December 10, 2021.

4. Source: J.P. Morgan. As of December 2021.

5. Source: Climate Bonds Initiative, Unicredit.